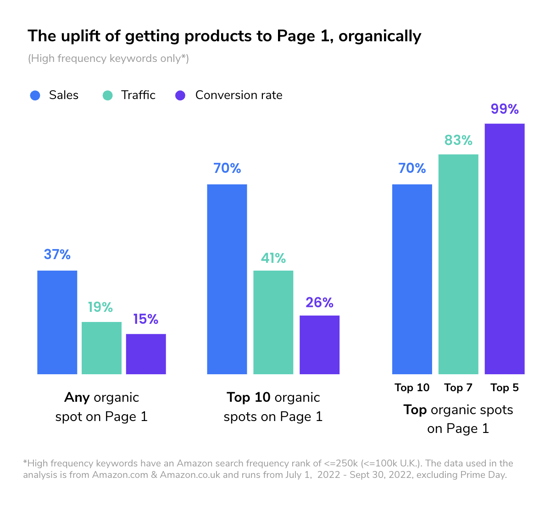

If you had any doubt that ranking high in retailer search results was important, just consult the latest research from Profitero: Products that move from Page 2 of search results to Page 1 (organically) increase sales by 37%; with those that go from Page 2 to the Top 5 spots of search resources doubling sales, on average.

Source: Profitero

But how should brands measure their search performance AND what are the common KPIs tracked by leading brands?

To shed light on this topic, Profitero surveyed 50+ brands across both CPG and durable goods categories, with a high concentration of brands among the largest sold online in their categories. We focused on metrics used in digital shelf reporting vs. sales / ROI-based metrics.

Here are the top-line findings:

1. Page 1 or bust

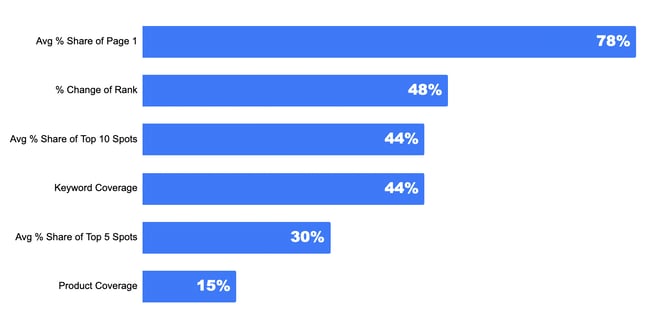

While brands typically see the highest sales uplifts in the Top 5 and Top 10 organic spots, this can be a stretch for the majority of brands (78%) who are primarily focused on measuring share of Page 1. This makes sense, given we’re still in the early days of eCommerce and search maturity. It's enough of a task just to get on Page 1 in the first place! As eCommerce capability continues to grow, we expect a greater focus on those all-important top spots moving into the second half of 2023 and beyond. In fact, our survey data reveals a sizable chunk of brands already prioritizing more advanced metrics, such as:

-

Percentage (%) change of rank: Tracking the specific spots where priority products rank on retailer websites and changes over time (48%)

-

Average % share of Top 10 spots (44%)

-

Keyword coverage: The total % of keywords where a brand has at least one product on Page 1 (44%)

What metrics does your company currently use for measuring and optimizing search performance on the digital shelf?

Source: Profitero

2. What to keep in, what to keep out?

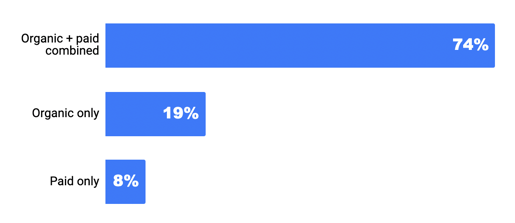

“Should we measure paid and organic together?" "Should we separate them out?" "What about 3P?”

These are questions we often hear brands wrestle with. Our survey provides some guidance.

-

74% of brands measure their search performance using organic and paid search placement together, versus separating them out.

-

Only a small percent of brands (19%) measure organic only, likely because some industries (like alcohol) have limited ability to advertise. Plus, some eCommerce teams are exclusively focused on organic SEO vs. paid media strategies, which are handled by marketing.

Do you measure search KPIs based on organic and paid or just organic?

Source: Profitero

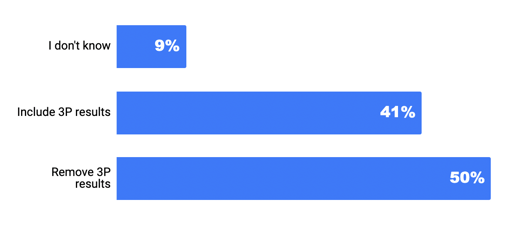

Meanwhile, brands are divided on how to treat 3P products in their search data — 50% remove them and 41% include them. Many brands sell both 1P and 3P and need a holistic view, while others may want to keep a close eye on 3P competitors who are piggybacking on their brand’s good name.

Do you include or remove 3P results from your reported search KPIs (as applicable for marketplaces like Amazon)?

Source: Profitero

3. Search trumps display (for now)

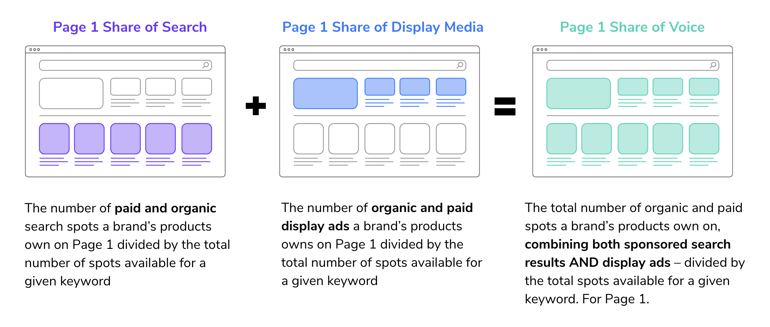

Many retailers (like Amazon, Walmart and Tesco) allow brands to sponsor search results and sponsor products with display ads. These display ads generally appear on the top or side of search results. This combination of paid search spots plus display ads constitutes the total Page 1 footprint a brand can own for a given set of keyword results.

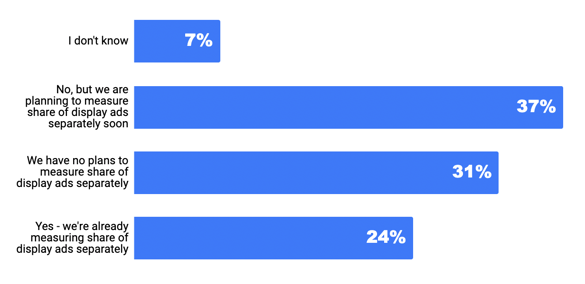

Currently, only 24% of brands surveyed measure share of display ads on Page 1, separate from paid and organic search results. But this will likely change in 2023 as 37% of brands not currently measuring display ads say they plan to do so soon.

It’s easy to see why brands may be heading in this direction. A February 2021 Amazon study found that brands that combined display and sponsored search ads saw a 78% sales average uplift, versus a 12% uplift for sponsored search ads alone.

Is your company measuring your share of display ads (separate from search results) on Page 1 of retailer websites?

Source: Profitero

This begs for a new unit of search measurement — Page 1 share of voice. This will allow brands to measure the holistic footprint of their Page 1 presence, combining ownership of display ads, sponsored ads and organic spots together.

Source: Profitero

4. One size doesn’t fit all when it comes to keywords

A brand’s search performance is defined in relation to a keyword or specific term a shopper enters into retailer search engines to locate products. Keywords are the digital equivalent of a shopping aisle and brands always want the best placement where the traffic is highest.

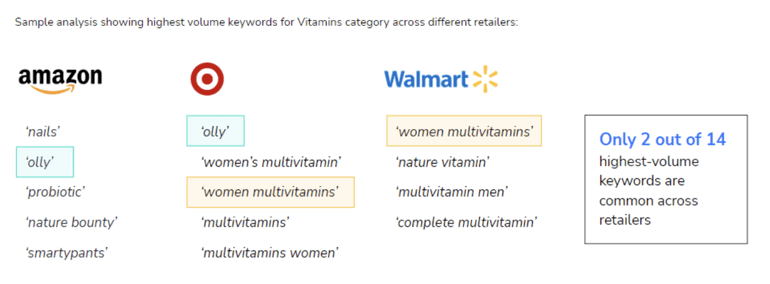

Using our Search Optimizer solution, Profitero has found keyword volume to vary a lot by retailer. This vitamin category example demonstrates how a keyword that is highly searched on one retailer may not be as highly searched on another:

Source: Profitero

Understanding keyword volumes by retailer matters for a few reasons:

-

You can tailor your SEO content and paid media strategies to optimize for the highest potential keywords by retailer

-

You get a clear understanding of the long-tail keywords you may want to target for pulling a brand up in an organic rank where it’s not already strong

-

You can get a better sense of the brand competitors who dominate mind share and fine-tune your conquesting strategies

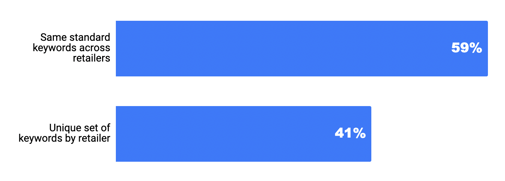

According to our survey, four of 10 brands (41%) are ahead of the curve and are already setting search performance goals using a unique set of keywords by retailer. In other words, they invest in understanding which keywords have the highest search volumes by retailers, versus assuming the same set of keywords are searched the same way across all retailers. Expect this number to grow in 2023, especially as more retailers enable the ability to target paid media by keyword.

Do you set search performance goals based on a unique set of keywords by retailer (i.e., understanding search volume by retailer) or do you use the same standard keywords across retailers?

Source: Profitero

5. Keeping tabs on competitors

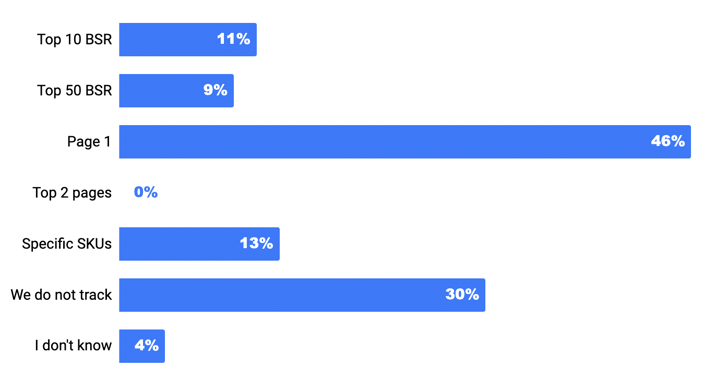

Two-thirds (66%) of brands are tracking competitor search performance in addition to their own products. How brands define competitors varies, but the majority use Page 1 as the cutoff point for determining which products to pay close attention to.

The number of brands tracking competitors seems low given that share of search clearly drives sales and thus is a leading indicator of market share growth. One would expect brands to be keen to measure competitors just as they might using sales data through IRI or Nielsen, and use that data to inform targeting strategies. But on the flip side, few retailers offer the ability to directly conquest competitors. So the actionability of this data may be limited — deeper digging must be done here.

Do you track competitors' search rank? If so, you do it for products in:

(BSR = best seller) Source: Profitero

Next steps: How can you act on these findings?

There is no right or wrong way to measure search performance on the digital shelf — it really depends on your maturity and capability to act on data. That said, the search performance survey data underscores some best practice approaches that we recommend.

Beginner

If you're not measuring search performance today, start simply by measuring your organic and paid share of Page 1 for key retailers. 'Key' retailers can be defined as those who (a) represent the largest bulk of your online sales; (b) offer the ability to influence search ranking via paid advertising or SEO (search engine optimization).

Do your homework to understand which keywords matter most by retailer versus treating all retailers the same — really focus on where to double down. Weigh your share of Page 1 for highly searched keywords differently than those with lower search volume. Finally, set up alerts to know when priority products are falling off of Page 1 as that will dramatically impact sales performance.

Intermediate

After you start increasing your brand's share of Page 1 for priority products, you can then raise the stakes to focus on the Top 10 (or even Top 5) spots. Many brands we work with classify their product portfolio into three buckets: gold, silver and bronze — and set goals accordingly.

For example, the goal for gold products is to get them in the Top 5 spots, whereas silver products should aim for the Top 10 and bronze products should aim for Page 1. At this stage, start looking at competitor search performance so you can adequately adjust budgets and account for new products winning the keywords you want. Be sure to include private labels in your competitor list, especially as inflation increases trade-down behaviors in your categories.

Advanced

Once you've mastered search — you're making steady progress on getting products to Page 1 and the Top 10 spots — then you may want to layer in display ad tracking and start measuring your total share of voice for Page 1. You’re paying a lot for display ads, so first and foremost make sure retailers are featuring them as planned (i.e., compliance tracking). But only do so if your organization — and retailers — are set up to act on these metrics.

Want to learn more about which

|