Note: Private label share of page 1 research updated Jan 23, 2023

Changes in consumer spending patterns, including some switching to lower-priced private label goods, are inevitable as shoppers increasingly become cash-strapped in a down economy. This makes it all the more important that brands monitor changing marketplace dynamics and take action to protect their market share.

Tightening of the purse strings is inevitable

Consumers are feeling the heat of inflation on their pocketbooks. Today’s living expenses are costing the average consumer $460 a month more than last year, reports NBC News.

-

Gas prices remain elevated: Filling the tank these days costs double what it did two summers ago.

-

Overall U.S. consumer prices (online and offline) jumped 9.1% in June, with food price inflation hitting a 40-year high. A similar impact is being felt in the U.K. as the inflation rate hit a new 40-year high of 9.1% in May.

-

According to Profitero’s monthly eCPI data, U.S. online prices in June 2022 are up 12% since June 2020 (the base month).

Profitero eCommerce Price Index shows a dramatic increase in online prices

These economic pressures (among others, e.g., increased rents, healthcare, etc.) are taking their toll and changing the way consumers shop and spend. Some things to watch for:

-

More focus on needs (i.e., non-discretionary purchases like food, fuel and shelter) over wants (apparel, entertainment, travel, etc.)

-

Less eating out, and more preparing and consuming food at home

-

Cutting back on spending and/or trading down to cheaper alternatives, e.g., switching to discounters like Aldi and Save-A-Lot; buying more private labels versus national brands

Sizing up the private label threat

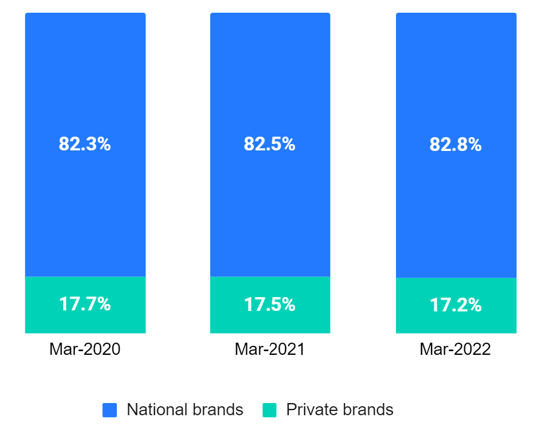

Despite food price inflation creeping up the past two years, national brands have held their own in terms of market share, maintaining and even slightly growing dollar share versus private labels.

National brands have retained their food dollar share* the past 2 years,

but this could change given high inflation

*Defined as IRI’s all-outlet food market

Source: IRI data cited in a June 2022 Food Marketing Institute (FMI) report, as reported by Ad Age

However, as inflationary pressures worsen and the economic outlook darkens, an uptick in private label consumption can be expected as shoppers look for more ways to stretch their dollars.

More than 40% of consumers say they have been buying more private brands now than before the pandemic, according to The Power of Private Brands report from the Food Marketing Institute (FMI). Furthermore, three quarters of shoppers anticipate continuing to purchase more private labels in the future.

This means brands will face more threats from private labels in the coming months. This threat is magnified online because retailers typically hold a large share of Page 1 in search results compared to national brands, and this share is likely to increase as retailers push their own private label agenda. We know from our past research how critically important being on Page 1 is for sales: You get a 50% bump in sales by moving from Page 2 to Page 1; Moving into a top 10 spot nearly doubles your sales. So as private labels gain share of Page 1, national brands are sure to lose it and in effect, lose sales too.

Private label dominates search results for 'ibuprofen' on Target.com

Private label brands have significant representation in the top search results for Grocery categories across key retailer sites — December 2022

| Amazon.com | Walmart.com | Tesco.com | |||

|

CATEGORY |

PRIVATE LABEL SHARE OF PAGE 1 |

CATEGORY |

PRIVATE LABEL SHARE OF PAGE 1 |

CATEGORY |

PRIVATE LABEL SHARE OF PAGE 1 |

|

crackers |

36% |

milk |

40% |

chicken |

82% |

|

chips |

22% |

canned food |

38% |

milk |

74% |

|

garbage bags |

16% |

cookies |

28% |

nuts |

72% |

|

pasta sauce |

16% |

coffee |

24% |

cookies |

62% |

|

coffee |

15% |

chips |

20% |

crackers |

59% |

|

cookies |

14% |

frozen food |

18% |

soup |

56% |

|

peanut butter |

13% |

crackers |

16% |

rice |

53% |

|

toilet paper |

12% |

peanut butter |

13% |

cheese |

50% |

|

pain killers |

10% |

dog food |

12% |

pizza |

48% |

|

soup |

9% |

body wash |

6% |

orange juice |

29% |

Example: Chips — Change in share of Page 1 on Walmart.com

| BRAND |

SHARE OF PAGE 1 |

SHARE OF PAGE 1 |

PERCENTAGE POINT CHANGE (ppt) |

| Lay's | 23.5% | 15.3% | - 8.2 ppt |

| Frito-Lay | 17.8% | 20.2% | + 2.4 ppt |

| Pringles | 8.7% | 4.3% | - 4.4 ppt |

| Doritos | 8.5% | 14.4% | + 5.9 ppt |

| Great Value (Walmart PL) | 6.0% | 19.4% | + 13.4 ppt |

Source: Profitero

Example: Peanut Butter — Change in share of Page 1 on Tesco.com

| BRAND |

SHARE OF PAGE 1 |

SHARE OF PAGE 1 |

PERCENTAGE POINT CHANGE (ppt) |

| Meridian Foods | 18.3% | 15.6% | - 2.7 ppt |

| Whole Earth | 16.8% | 27.4% | + 10.6 ppt |

| Sun-Pat | 11.2% | 8.0% | - 3.2 ppt |

| Tesco PL | 10.8% | 20.2% | + 9.4 ppt |

| Marmite | 6.4% | 3.0% | - 3.4 ppt |

Source: Profitero

So what, Now what? What can brands do?

National brands need to be on high alert, using a “hands-on-keyboard” approach to mitigate the private label threat. This means regularly tracking competitive dynamics on the digital shelf, daily if possible, so you can take actions needed to minimize potential sales & share loss.

What can brands do to stay ahead:

-

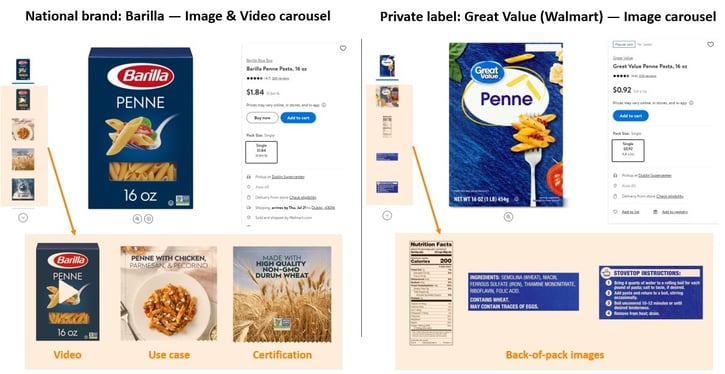

Make sure your product content is relevant and differentiated. How you communicate your price / value proposition is key, especially when competing with low-price private label options. So, be sure to review your promotional and social strategies to ensure the right message is being shared. And update your product content—images, descriptions, bullet points, etc.—in a way that will differentiate your brand from private labels. Think strong hero images, videos, romance copy, recipe links, personalized messaging, etc.

Use every pixel to its finest to communicate brand equities

-

Do what it takes to retain your share of Page 1. Keep tabs on your share of Page 1 versus that of the competition—including private brands—for your top general and branded keywords. Be sure to monitor changes over time and watch for any unusual trends. This way you can take appropriate measures, e.g., stepping up paid search or investing in organic search, when needed.

-

Analyze price elasticity and review your price pack architecture. Now is a good time to analyze your pack sizes to play with value dynamics as a way to keep value conscious consumers buying your brand. Brands can win by identifying incremental packs that the retailer doesn’t carry within their private label offering. Or maybe the time is right to think about ways to bundle products that will provide solutions and/or savings to consumers, or will mimic the club mentality of stocking up at a savings. Or maybe it’s figuring out how to bundle your brand with a complementary private label product, and then promoting it via a banner ad on the retailer’s site.

-

Focus on retention-based tactics to try to limit brand switching. As shopper trade-down activity heightens, it’s more important than ever to stay in the consideration set and win re-purchase. Shift your focus to more retention-based tactics, if not already doing so. Invest in subscription programs, like Amazon’s Subscribe & Save, and other lock-in mechanisms (e.g., “buy again” lists). Also leverage any acquired first-party data to retarget your current customers with reminders on items they’ve bought already, to upsell or basket build.

-

Leverage Ratings & Reviews, online and offline. Consumers prefer brands they know and trust. This is why product reviews are among the top criteria consumers use when purchasing items online. It’s also why it’s important to leverage your reviews as much as possible—across your PDPs, in your content, even on the store shelf. It can help your products shine versus private brands; it’s also often a key criteria driving retailer search algorithms. So be sure to closely track your Ratings & Reviews: Look for and address any new negative reviews; stay on top review recency or currency; and boost reviews via syndication to differentiate and power search.

The above list of metrics relies, of course, on having the right resources in place, both people and data.

“Brands that win will be those that can track their leaky bucket and understand progress over perfection. eComm data is an unmapped jungle. If you wait until you can map the entire jungle, you'll never win. But if you have a good jungle guide (internal talent and external partners) that can read and react to the different situations once you enter the jungle, you have a better chance of being effective and efficient with your resources.”

— Todd Hassenfelt, eCommerce Director at Colgate-Palmolive

Talk to your Account Manager or contact us to learn more ways to defend your market share and fend off the threat of private labels.

For more eCommerce insights & reports:

Follow us on LinkedIn

Follow us on Twitter

Stay informed with Profitero’s latest newsletter

Contact us for business or press inquiries

———

Follow us on LinkedIn

Follow us on Twitter

Stay informed with Publicis Commerce Insights

Contact us for business or press inquiries