We all know what it's like to be overwhelmed by information. Just look at your email inbox after a week of being on vacation. It’s not fun and there’s a cost (both personally and professionally) to trying to sort through all those emails you get to find what’s truly valuable and actionable.

Brands often have the same experience of being overwhelmed by digital shelf data. They confuse quantity with quality (i.e., actionability) and procure more data than they can handle. Instead of greater clarity, they introduce unnecessary complexity, higher costs and confusion for their employees.

For example, what's the point of tracking weekly all-store data if by the time you action it, the issue has changed? What's the point in tracking all keywords when most of them have little to no impact on the business?

Our most recent industry survey shows this gap between data acquisition and data actionability: While 70% of brands now have some form of digital shelf auditing tool in place, only 31% are regularly tracking and communicating these KPIs to their organization.

Brands therefore need to take a more strategic approach to data. Before even evaluating suppliers (and being tempted by shiny data features), they must define the level of digital shelf data required, based on their eCommerce maturity and resourcing levels. And only then will they have the clarity from which to make the right supplier decisions.

In this sense, Goldilocks had it nailed. She knew what she wanted: not too much, not too little, just right. Brands should take a ‘Goldilocks approach’ when it comes to digital shelf data and choose just the right amount to be actionable. But how?

Here is a 5-step strategy:

1. Define retailer data requirements

The quantity of data you require for your retailers must be driven by your ability to drive action. You may, therefore, not need the same level of data for each retailer.

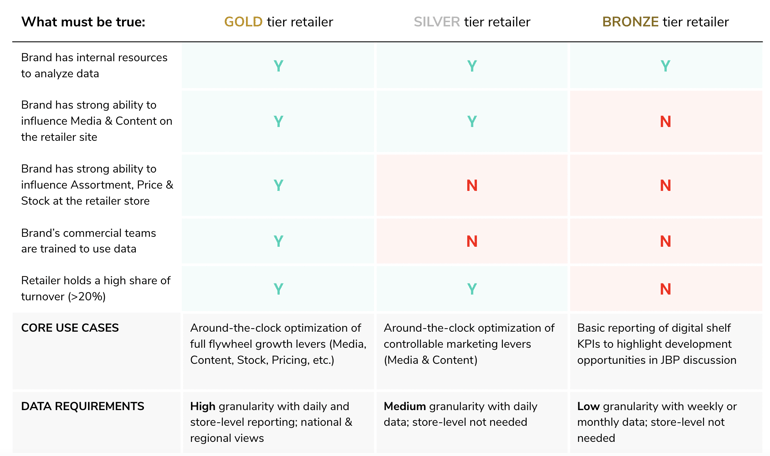

Start by segmenting your retailers using the following criteria:

-

Do I have the internal resources to analyze the data?

-

Do I have a strong ability to influence my media and content on the retailer site?

-

Do I have a strong ability to influence Assortment, Pricing and Stock with the retailer?

-

Are the commercial teams trained to use the data to be able to influence retailers?

-

Does the retailer hold a high share of my turnover? (>20%)

Based on your answers, you can start to segment your retailers into Gold, Silver and Bronze tiers which correlate with the level of data you need:

2. Use a smart representative sample of stores

Once you have your retailer segmentation, you can now determine the level of granularity needed for tracking data at the store level. By “store level” we mean the ability to collect attributes like price and availability based on a specific location of the shopper (such as zip code).

From the exercise above you can already see that not every retailer requires store-level data. Since media and content typically don’t change at a store level, the need for store-level data comes down to which retailers you can influence when it comes to Assortment, Price and Stock — and how trained and capable your sales teams are to action this type of data.

The question then is: How many stores should you track?

While it’s possible to get data from every store, we don’t recommend brands start there as that amount of data can be overwhelming.

This sentiment is driven by direct feedback from users of full store level data — it doesn’t match up to expectations due to:

-

Lack of data accuracy leading to a lack of trust. The data reported online (e.g., availability) often doesn’t reflect the in-store reality due to retailer systems. For example, differences in store scanning procedures means products can be recorded as in-stock, but in reality can be stuck in the store warehouse. That damages trust in the data which, once gone, is very difficult to recover.

-

Full store data providing a poor user experience — resulting in slow performance of digital shelf tools. Once you have it, the sheer quantity requires data science capabilities to highlight even the most simple action. User report this results in frustration for their teams and an inability to drive any action from the data.

In summary, I don’t trust it and I just can’t use it. And quite frankly, it’s not necessary to achieve the mission at hand.

This led us to investigate: What is the right amount of stores?

We started with our data scientists and gave them a challenge: How can we provide the best user experience by choosing the right number of stores that still maintains a high level of accuracy, and also ensures you can action it?

Using clustering analysis to identify stores which consistently show the same availability and pricing behavior, we found that a sample-based approach can deliver just as good a result as tracking all store locations. In fact, we found it can guarantee a minimum 90% accuracy when compared to data from all stores. At the same time, we’ve ensured full national coverage by matching chosen store locations to retailer distribution centers. Regional availability issues can therefore be easily identified and actioned.

This ‘Goldilocks' approach to store-level data is also much more sustainable for the retailer who wants to minimize bot traffic to their website as much as possible to ensure fast load performance for consumers.

It’s important to remember that panel based data has always been a key feature of CPG data analytics from global leaders such as IRI and Nielsen. Manufacturers invest millions each year on promotional spend and shopper marketing displays on the back of data which provides just the right amount of data — not too much.

3. Focus on core products that move the needle

Now that you’ve landed on the right amount of stores to track, it’s time to think about what products to track.

Having access to data for your entire portfolio may sound appealing — but what will you do with it?

What matters most on the digital shelf is the priority products which drive the majority of your sales. Based on our research on CPG clients selling on Amazon in the U.K. and U.S., 80% of manufacturers’ sales typically resulted from just 15-20% of SKUs.

For brands with large portfolios, the size of the long tail of SKUs can be significant. If multiplied by hundreds of store locations, you’re looking at thousands of data points that are simply unactionable.

This reflects a key difference between in-store and online assortments. In-store, all products are visible, with some simply in better positions based on their planogram location. Online, shoppers only see what’s showing up in search results, with 70% only looking at Page 1. This influences sales and leads to a smaller percentage of products online which drive the majority of sales.

So we encourage you to think clearly about which products you need to monitor at the most granular store level. If you’re not going to action it, don’t measure it.

4. Make daily data a must-have

Frequency of data plays a key part in data actionability increasing your chance to negate any negative impacts of digital shelf performance. And thus, it needs to weigh heavily into supplier decisions.

For example, being just 2 days out-of-stock can require up to 10 days for your organic search rank to be recovered. Therefore, do you really want to wait a week to learn that a key SKU has been out of stock? Similarly, we have clients who struggle all the time with 3P sellers changing their content on Amazon. One even had a 3P seller replace their hero image (which was a picture of their deodorant product) with a machine gun. Do you want to wait a week to learn about something like that?

Agility is the key to success.

Most digital shelf analytics providers offer one of the following:

-

Daily updated and reported data — providing the most frequent impact of digital shelf actions

-

Weekly or monthly reported data — an aggregated overview over a given period without being able to isolate individual days

Reporting data at a weekly level removes your ability to understand the fundamentals driving your performance. As a result, your ability to react quickly is severely hampered.

More importantly, you won’t be able to satisfy these key use cases for driving digital shelf performance:

-

Increase your reaction time to factors that may be negatively impacting sales, such as out of stocks and MAP violations

-

Expose nuances in the data that may correlate with specific days of the week that can help you better tailor strategies

-

Diagnose the causes and effects of data anomalies, such as dramatic spikes or dips in sales, more accurately and efficiently

All Profitero data is updated and reported daily across every single measure. We firmly believe there really is no other way.

For more details on this discussion, please read our blog on the power of daily data.

5. Prioritize the right benchmarks and keywords

The reality of choosing too much data is that brands are stuck in a position of struggling to pull clear insight, rather than driving real action. Digital shelf data must reduce wasted effort through focusing attention only on growth opportunities.

From our latest global survey, there is positive momentum in the industry to use data in the right way. One-third of all manufacturers are using causal analytics to understand the right levers to pull on the digital shelf by combining analytics with eCommerce sales tracking. This figure has grown by 55% since 2022, but we want to see that much higher over the coming years.

So in addition to thinking about the level of data you need, you also need to evaluate suppliers based on their ability to help you drive informed actionability. A few areas to focus on:

-

Search optimization — Only 1 in 7 keywords in your category are common across retailers, so you need retailer-driven recommendations to guide your content and search optimization strategies, which are provided by Profitero’s Search Optimizer.

-

Category growth drivers — Category drivers differ across retailers based on the complexity of their algorithm. Don’t waste your team’s time and investment on digital shelf drivers that won’t move the needle. Profitero’s Boost provides specific category growth drivers by retailer with a quantified impact on your sales rank. For more information, please see our report on decoding Walmart.com.

-

Shelf intelligent Media — Match our client who achieved a 10% week-on-week sales uplift and a 3x increase in share of Page 1, simply by conquesting a competitor product based on Profitero’s Digital Shelf analytics. Now you can achieve this with Profitero’s Shelf Intelligent media, in partnership with Skai and Pacvue.

All of the above focus on actionability through daily data with prioritized data choices based on retailers, stores and products.

Conclusion

Don’t confuse quantity of data with quality. Follow Goldilocks’ example and ensure you have just the right amount to connect a sales or search impact with every data point. If so, you’re doing it just right.

And if you want more help on these decisions, reach out to your Profitero Account Manager or contact us at sales@profitero.com.