Think about eCommerce as an iceberg.

The tip of the iceberg is the direct value created by the eCommerce channel itself, i.e., the direct ROI measured in terms of sales & share the channel generates.

But beneath the surface of the water is a massive chunk that’s creating indirect value in ways that may be hard to see or measure. This indirect value comes from a number of sources, but here are three primary ones:

-

Digitally influenced sales – the impact online has on offline sales

-

Audience expansion – considering shoppers you attract online (typically a younger demographic) may be different for your brand than your typical B&M shoppers

-

Greater lifetime value – since shopper loyalty online tends to be stickier than offline, there's more lifetime value potential

Let’s dissect the iceberg and its components to help you understand just how big and far-reaching the impact of eCommerce really is.

Measuring the ‘direct value’ of eCommerce

Everyone thought eCommerce was in decline when earlier this year the U.S. Department of Commerce reported that eCommerce sales had plummeted from 14.6% of U.S. total retail sales in Q3 2021 to 12.9% in Q4 2021.

An article published by The Wall Street Journal in April didn’t help matters. The article titled “The Pandemic Was Supposed to Push All Shopping Online. It Didn’t.” surmised that some “eComm retailers that rode a surge of online purchases in 2020 are now grappling with the fact that some customers have returned to stores.”

The questions on everyone’s mind became:

- Are consumers reverting to pre-pandemic in-store shopping patterns?

- Are my investment dollars misallocated? Should I pull back on eComm?

The short answer to these questions: Absolutely not! Doing so would be exceptionally short-sighted for several reasons.

1. eCommerce sales have been upwardly revised

In mid-May, the U.S. Department of Commerce course corrected, upwardly revising its eCommerce sales data.

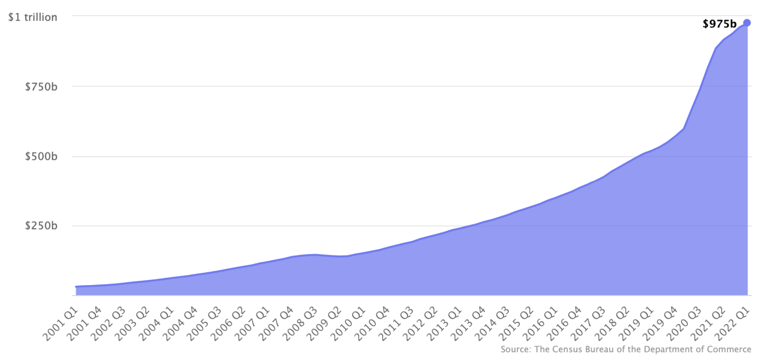

The restated figures show that eCommerce actually captured 14.3% of total U.S. retail sales in Q4 2021, substantially higher than the 12.9% originally reported, and more in line with previously reported eComm sales. eCommerce is well on its way to closing in on $1 Trillion.

U.S. eCommerce Trailing Twelve Months Sales

2. eCommerce remains on a growth trajectory

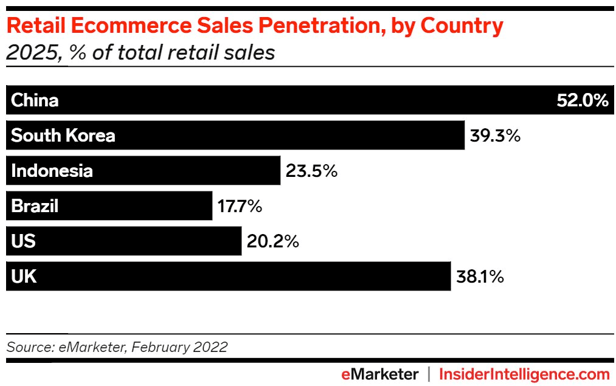

Experts forecast eCommerce will continue on its upward growth trajectory, and the figures are pretty eye-opening. Fast forward three years: eMarketer projects eCommerce will represent 20% of total retail sales in the U.S. (yes, $1 in every $5 will be spent online); nearly 40% in the U.K.; and more than 50% in China. Bad times are ahead for any company considering pulling back on investments by underestimating the secular shift to digital that’s been underway for some 20+ years.

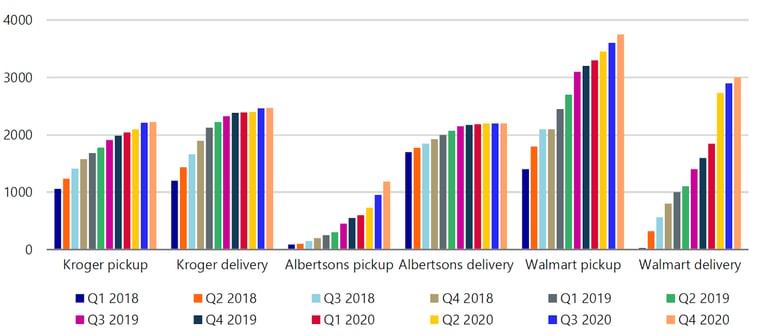

3. Retailers are leaning in heavily on eCommerce

The writing’s been on the wall for awhile. Retailers are rationalizing their store bases and reducing their physical footprints to instead focus more heavily on building eCommerce capabilities. Today, nearly every retailer has an online offer, many with their own marketplaces. And curbside pickup locations and local home delivery has been expanding.

Number of stores offering online grocery services by fulfillment modality

Source: Rabobank research based on company press releases and quarterly reports

Meanwhile, stores continue to close down. Some examples:

-

The National Retail Federation (NRF) reports that nine retailers have announced plans to close 100+ stores this year, among them American Eagle Outfitter, Footlocker and Francesca’s.

-

CVS intends to close 900 stores in the next three years; Macy’s, 125 stores by 2023; and in 2021, Chico’s announced 1,000+ upcoming store closures.

-

Christopher & Banks filed Chapter 11 in January 2022, closing 449 stores in the process. It wouldn’t be surprising to see more retail bankruptcies this year given the current recessionary environment.

Measuring the ‘indirect value’ of eCommerce

Despite the escalated growth of eCommerce in recent years, brands can no longer think, measure and invest in terms of just “eCommerce.” The impact is much greater than that. Thinking this way requires a change in mindset, taking into account the many ways digital is influencing your business and expanding your brand’s sales potential.

Here are three primary things to think about:

1. Digitally influenced sales

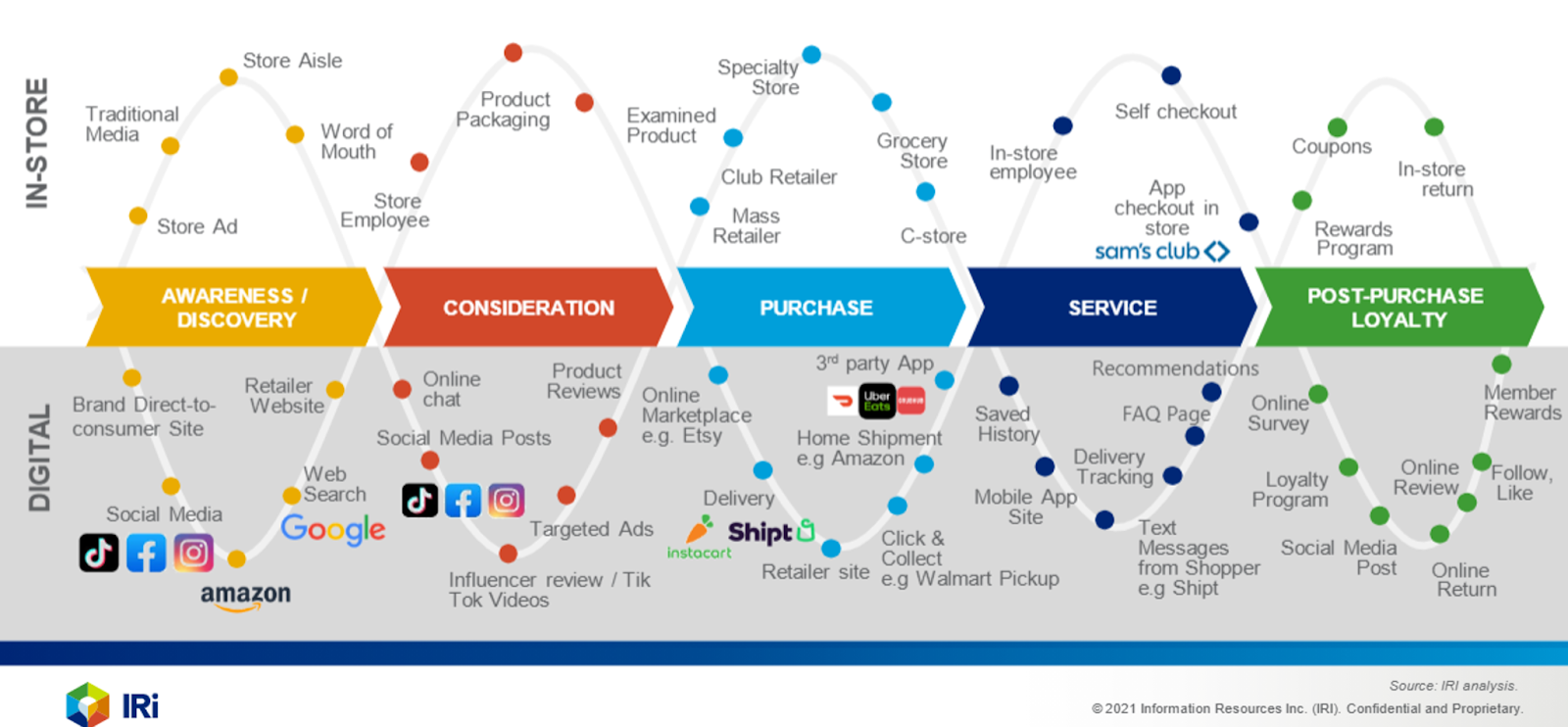

“Digitally influenced sales” take into account all transactions where a consumer has had a digital touchpoint along their path to purchase, regardless of where the sale ultimately happens — i.e., online or brick & mortar. It gives brands credit where credit is due for all the digital shopper marketing that engages consumers during their shopping journey. And in today’s increasingly omnichannel world, the lines are way too blurry to separate brick & mortar sales from digitally influenced sales.

How digital and physical touchpoints interconnect throughout the shopper journey

Consider these stats, which clearly support the interconnectedness of physical and digital:

-

The shopping journey often begins online before a consumer heads to the store. 81% of shoppers do online research before buying, according to data from GE Capital Retail Bank. This number is even larger – 96% (almost everyone!) – for big-ticket items or major purchases, according to a shopper survey by MFour. Think appliances, electronics, furniture, bicycles or home gym equipment, and baby gear. More than half of shoppers start their product search on Amazon.

-

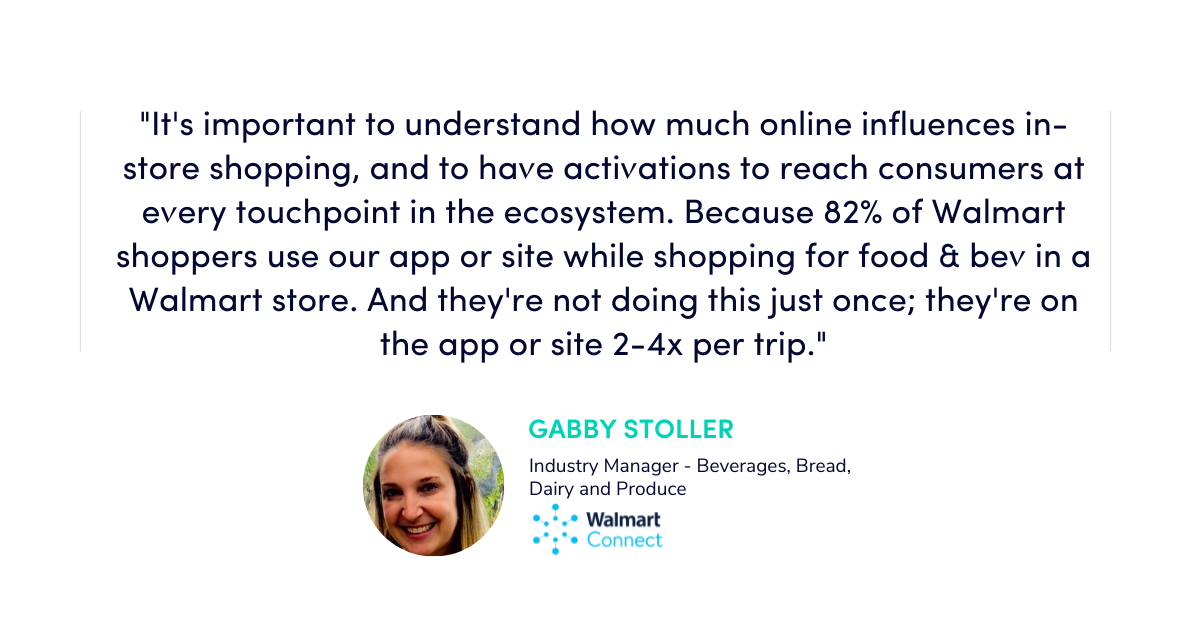

Many consumers use their smartphones – to check prices, download digital coupons, get detailed product descriptions, read reviews, etc. – while walking the aisles of a physical store. In fact, 82% of Walmart shoppers use the retailer’s app or site while shopping for food & beverages in a Walmart store, according to data that Walmart Connect’s Gabby Stoller, Industry Manager – Beverages, Bread, Dairy and Produce, shared during Profitero’s Heating Up! webinar in April.

-

Advertising on retailer websites has a halo effect on brick & mortar sales. A study by Analytic Partners found that up to 70% to 90% of the impact of Amazon display ads (DSP) drives sales in channels other than Amazon. A study by The Digital Shelf Institute found that for every dollar consumers spend online as a result of retail media campaigns, another $7 to $11 was spent offline in stores. This is a key reason why retail media is exploding and becoming a bigger share of total performance marketing budgets. Nearly 80% of respondents surveyed by Skai and BWG in January 2022 reported that at least 11%+ of their total marketing budget is retail media; 25% said retail media is now more than half their total marketing budget.

-

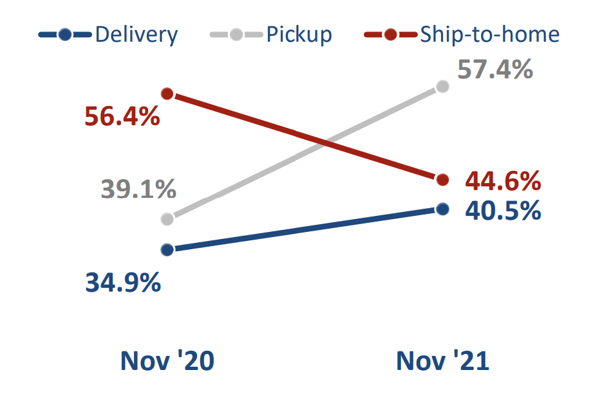

Curbside pickup (or Click & Collect) is now the most popular way consumers receive their online grocery orders. 57% of U.S. consumers used curbside pickup services in November 2021, up dramatically from 39% in November 2020, according to Brick Meets Click data. This massive increase in buy online pick up in-store (BOPIS) underscores how big omnichannel has become.

Methods Used to Receive Online Orders

(percent of monthly active users of online grocery)

Source: Brick Meets Click eGrocery Dashboard

2. Audience expansion

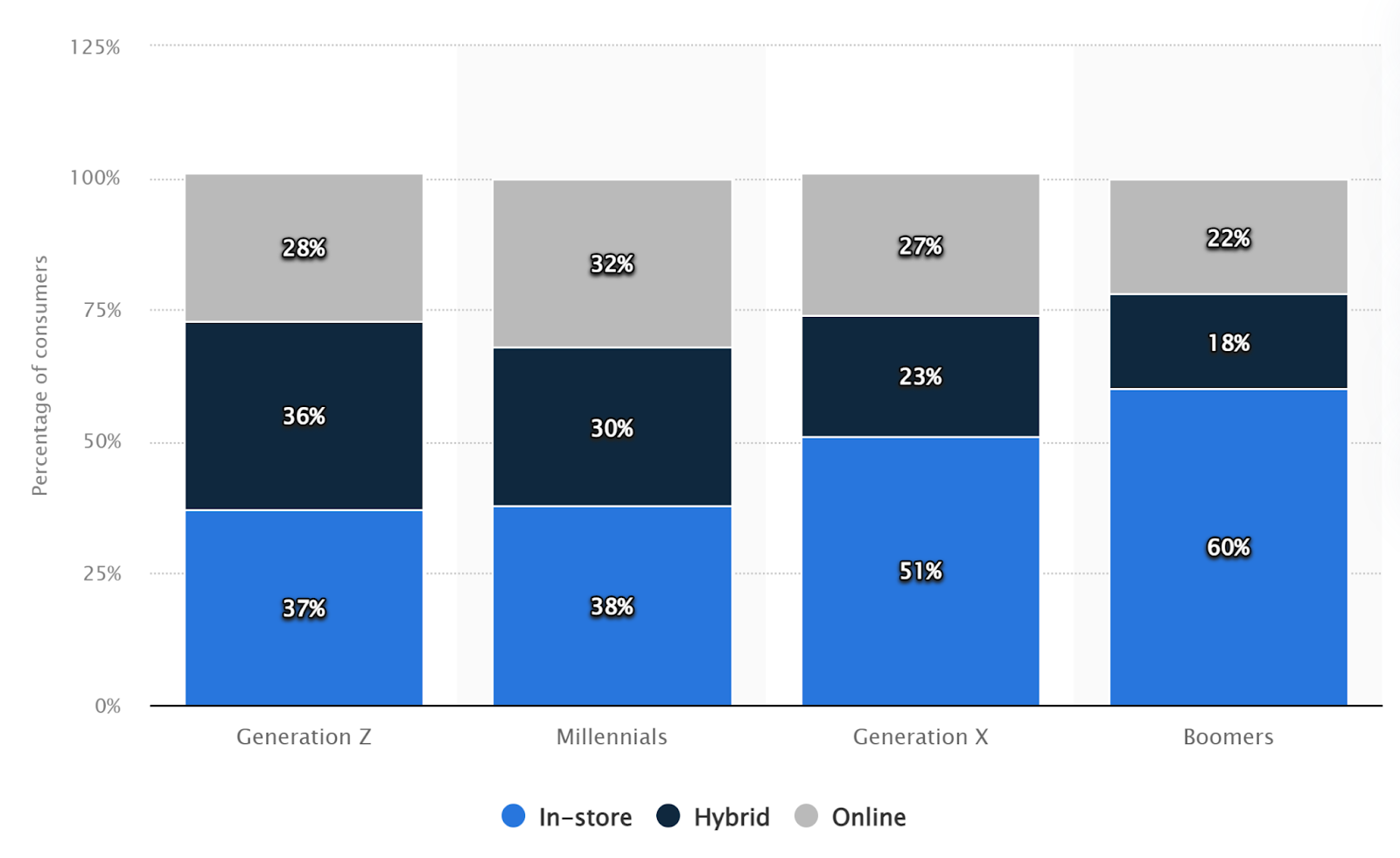

Brands also have to consider that the shoppers you attract online may be different than your typical brick & mortar shoppers. So, it’s important to think about your digital investments as part of a broader brand expansion strategy.

Online shoppers tend to skew younger – they are a mobile-first digitally native generation. Therefore, winning sales online with new, younger shoppers – especially as they move into their high purchasing power and household formation – could be worth substantially more than your core B&M demographic from a future potential lifetime loyalty value.

Primary shopping methods used among consumers worldwide in 2021, by generation

Source: Statista 2022

3. Greater lifetime value

Shopper loyalty online tends to be stickier than offline. What this means is that shoppers who buy a product online tend to be more likely to buy it again based on past purchases.

Globally, 49% of online grocery shoppers use the repeat purchase option, according to the EY Future Consumer Index. According to U.S. online shopping platform Instacart, after an initial purchase or two, customers are more likely to look for items in their purchase history than by using the search function. By their 10th order, 25% of conversions come from the “Buy It Again” section on Instacart.

It’s these kinds of stats that underscore the importance for brands to get in the cart or on a shopper’s favorites list early, and then reap the rewards of lifetime value.

So what, Now what?

-

Invest. Invest. Invest. Now is not the time to pull back on eCommerce investments. In fact, just the opposite is true. Underinvesting could set you so far back it may prove impossible to catch up. Brands that “get it” are staying the course, continuing to invest in digital, because (1) eCommerce remains on a growth trajectory; and (2) they understand the indirect value associated with eComm, including the growing share of sales that are digitally influenced.

-

Get on the digital shopping list — early. We’ve already shown how much stickier online shoppers can be than those shopping offline. Brands that invest in Search to generate awareness and get found, and in Content to drive conversions in order to get in the cart early will have a clear advantage over those that don’t.

-

Elevate retail media as a part of your performance marketing campaigns. Retail media is exploding with a growing roster of retailers adding capabilities. So, keep your ad spend flexible to move budgets around easily as needed. This is especially true when new keywords or competitors start trending in your categories and you want to optimize your ad campaigns around those trends. And make the most of your retail media budget by knowing which of your products already rank high in organic (and paid) search. This way you can be as efficient as possible with your ad budget, pulling back ad spending on highly ranked products and instead reallocating budget elsewhere.

-

Make sure your digital content and PDPs are ready to shine. Digital shelf space is more dynamic than the shelf space you have in a physical store. So make the most of it: Optimize your digital real estate for search so you are discoverable and get found; Create content that converts, leveraging a combination of imagery, video, A+/enhanced content, live streaming, and more; Ensure you have plenty of reviews, and importantly recent reviews.

-

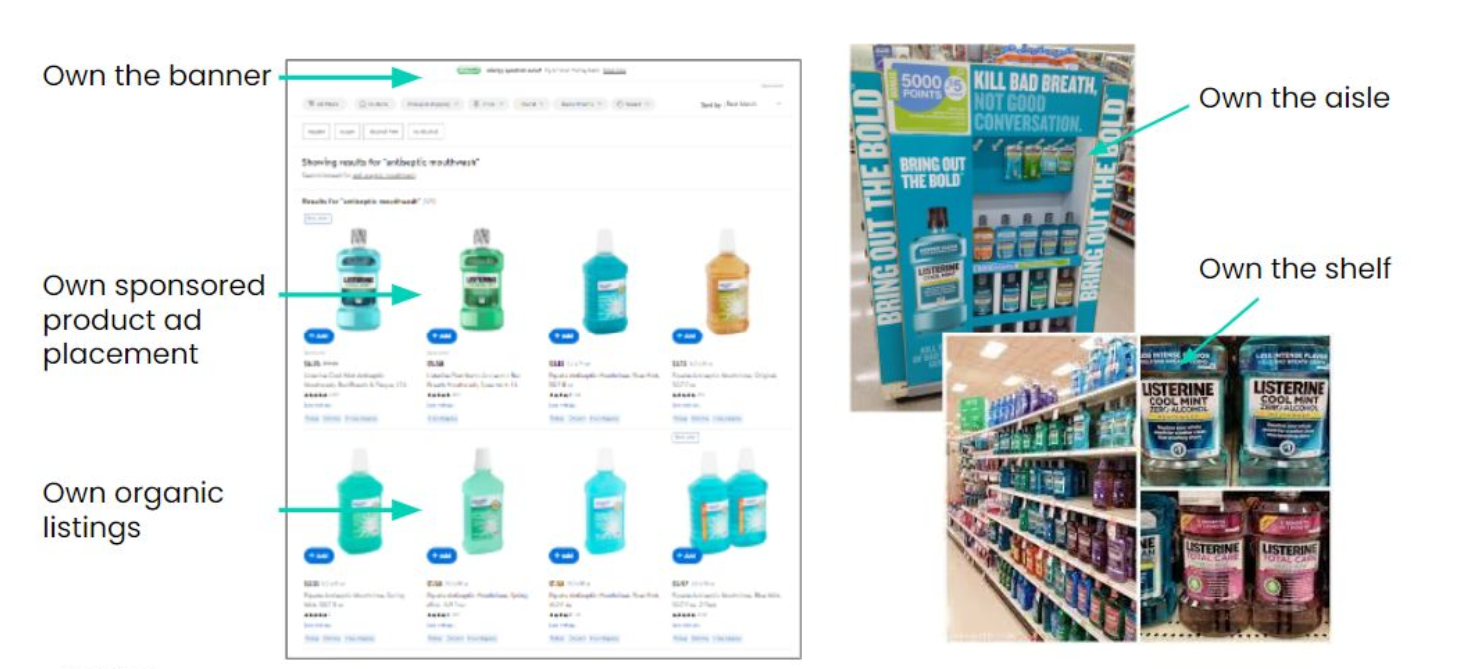

Understand that your digital shelf is a continuity of your physical shelf. Therefore, it ultimately should be "owned" by the same teams who own performance of the physical shelf across your key retailers, whether that’s sales, shopper marketing, category management, or some combination of all three. It takes a village to maximize digital sales and growth. And these teams should be held accountable for performance on the digital shelf the same as the physical one.

Think of the digital shelf as a continuity of the physical shelf

Contact us to learn how Profitero can help set up your team to better monitor and manage your digital shelf at scale across all your retailer partners.