The Challenge: Increasing competition impacts performance & share

It’s fair to say the retail media market is running hot. Skai has reported an incredible 10% growth in retail media spend in Q3 from the previous quarter alone. Our eCommerce benchmark study found that half of brands plan to increase their retail media budgets next year, and eMarketer expects another year of 20% growth for the retail media market in 2024, for a total of $55 billion in the U.S. alone. Clearly, the risk of missing out is high.

But there’s another, equally important risk. With growing budgets come higher expectations for ROAS and incrementality. Finding a balance of ROAS, new to brand acquisition, and maintaining repeat purchasers is harder to maintain.

We’re already seeing this dynamic play out. Just look at Pacvue’s year-on-year figures for Black Friday ad spend on Amazon:

.png?width=575&height=384&name=12.23%20Building%20blocks%20blog%20chart%20(6).png)

An incredible 59% increase in spending this year underscores that brands are all-in on retail media, but ROAS dropping 26% and conversion down 11% from 2022 signals that an increase in competition and 3P sales are taking a toll on the efficacy of this media spend. For the vast majority of brands that don’t have the budget to outspend everyone else, winning at retail media in the coming year will mean being strategic and smart about retail media buying to help their ad dollars go farther. How can brands achieve this?

The Solution: A smarter, scalable, targeted retail media strategy

To ensure their media drives short- and long-term growth, top global brands are partnering with Profitero to integrate digital shelf signals with their media campaigns for smarter, more targeted buying. Our Shelf Intelligent Media solution, in partnership with Skai, Pacvue, and several DSP partners allows brands to optimize retail search bids and budgets against signals like brand and competitor availability, as well as other signals that are predictive of changes in shopping behavior and media performance, enabling us to drive both efficiency and growth through media.

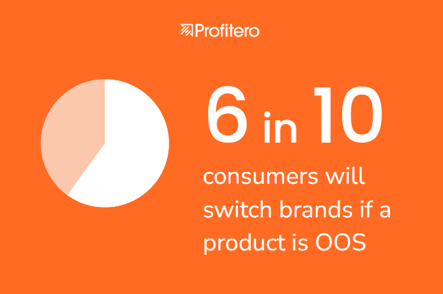

One of our most impactful signals is competitor availability. Why does this work? Profitero’s consumer survey earlier this year found that 6 in 10 shoppers will switch brands if the product they’re looking for is out of stock. And our research shows that 1 in 5 products are out of stock on any given day. Capitalizing on these moments when shoppers are more likely to convert with your brand drives sales growth as well as higher ROAS.

The Results: New buyers, more sales, higher ROAS

Using Shelf Intelligent Media with Pacvue, Kraft Heinz’s Philadelphia cream cheese – a category leader that lost market share in early 2023 – saw a 28% increase in new-to-brand buyers and 25% more ad-attributed sales. The return on their spend improved, too: when Shelf Intelligent Media was activated on days where competitors were out of stock, ROAS increased by 12%.

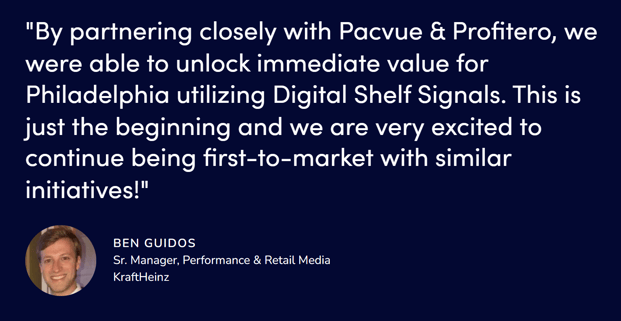

Ben Guidos from Kraft Heinz shared his team's experience with Shelf Intelligent Media:

And Philadelphia wasn’t the only brand that saw a jump in performance thanks to more targeted media buying: a leading makeup brand saw a nearly 2x increase in ROAS using Shelf Intelligent Media’s Skai integration:

.png?width=456&height=456&name=Soda%20(1).png)

See what Peter Vasilakos, VP of commerce at Zenith, had to say about Shelf Intelligent Media's Skai integration:

.png?width=669&height=350&name=Quote%201%20(4).png)

This is just the tip of the iceberg for Shelf Intelligent Media as we continue to amplify performance with more digital shelf signals, enable more retailers, and expand beyond the US & EU5 in 2024.

Want to ensure that your brand’s retail media strategy drives sales growth, attracts new buyers and achieves a higher rate of return? Request a demo of Shelf Intelligent Media here.