Here are snippets from Profitero’s latest press coverage. See how our eCommerce analytics and expertise are helping brands spot the biggest trends happening across the digital landscape.

Back-to-school trends: Hard to find, and pricey

Excerpted from USA Today and Yahoo Finance

Some school supplies could be harder to find and may sell out this year – and not only on the eve of the first day of school. Backpacks, shoes and some gadgets are expected to be this year's shortage items, experts say. Analytics company Profitero surveyed 500 consumers this week and found that 61% of those who started their back-to-school shopping have run into issues with products being out of stock or unavailable. […]

Aside from the risk of items selling out, experts say parents should also consider shopping early to combat the possibility of rising costs. Not all parents have that option yet. Profitero found in its survey that half of the consumers surveyed said their school districts had not released back to supply lists.

"All signals suggest that price inflation and shortages will only increase the deeper we go into the back-to-school season,” said Mike Black, Profitero chief marketing officer. “Especially as it relates to pricing since there is no incentive for retailers to lower prices. So the longer people wait to buy, the more likely they will be upset with the results.”

Excerpted from Multichannel Merchant

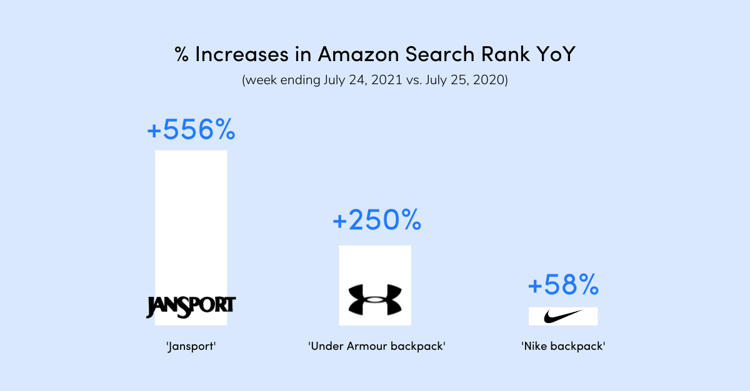

The […] concept of brand trust is also a big deal for back-to-school shopping in 2021. Profitero found that the terms “Jansport,” “Under Armor backpack” and “Nike backpack” saw major upticks in Amazon search rank in the end of July vs. 2020, up 556%, 250% and 58%, respectively. Not surprisingly, Amazon was the low-price leader, Profitero found, averaging 18% cheaper for school supplies/essentials and 8% cheaper for school tech.

‘Back to work’ searches heat up

Excerpted from Adweek

As companies grapple with the future of office-based work in the unpredictable era of Covid-19, employees are also starting to think about—and shop for—a return to the physical workplace. According to data from ecommerce analytics firm Profitero, the surge in search terms related to back-to-work purchases suggests that the trend could rival back-to-school shopping as the academic year approaches. Searches for makeup, office attire, on-the-go snacks and pet cameras have skyrocketed, some by several thousand percent compared to last year at this time.

As companies grapple with the future of office-based work in the unpredictable era of Covid-19, employees are also starting to think about—and shop for—a return to the physical workplace. According to data from ecommerce analytics firm Profitero, the surge in search terms related to back-to-work purchases suggests that the trend could rival back-to-school shopping as the academic year approaches. Searches for makeup, office attire, on-the-go snacks and pet cameras have skyrocketed, some by several thousand percent compared to last year at this time.

“We’re seeing a shift in pandemic shopping behavior and the beginnings of a return to normal for many products that were hit hardest by social distancing,” Profitero president Sarah Hofstetter said in a statement.

Beauty products saw some of the biggest spikes this year compared to last, with Amazon searches for makeup brush sets up 7,766% in the last two weeks in July when compared with the same time period last year. Searches for foundation makeup jumped by 539%, concealer by 240% and liquid eyeliner by 148% this year compared to last. Office attire also saw a big jump, with searches for women’s blazers up 2,000% compared to last July, when sweatpants were the only thing that mattered.

(For more data, click here)

Amazon deals for Prime Student members

Excerpted from Yahoo Finance

Amazon offers the lowest prices on back-to-school products and college supplies, on average 10% less than other retailers, according to a recent study by ecommerce analytics firm Profitero. Customers can find trendy dorm room décor and bedding, clever storage solutions and furniture for small spaces, electronics, school supplies, and much more—the widest selection of college essentials with low prices and convenient delivery options. Plus, Prime Student members can enjoy unlimited fast, free delivery on millions of items.

Pepsico squeezes juice from its lineup

Excerpted from Modern Retail

As fruit juice consumption steadily declines in the U.S., PepsiCo and peers shift their beverage investments elsewhere. In August, PepsiCo announced that it would be selling a controlling stake across its North American juice brands, like Naked and Tropicana, to private equity firm Pai Partners for $3.3 billion. The deal is another sign that the fruit juice market is losing steam. […] When people do drink juice these days, they drink it in different formats like flavoring agents for seltzer, fruit juice shots or pressed formats.

Christina Vail, director of client services at e-commerce insights platform Profitero added that product and ingredient costs rose during the pandemic. As such, PepsiCo and other food and beverage brands are especially eager to optimize. Over the pandemic, food and beverage conglomerates have consistently trimmed or adjusted their product offerings.

Visit Profitero’s Press page for more insights and press highlights.