60% of brands regularly report and analyze online sales & share data for priority retailers like Amazon, according to Profitero’s latest eCommerce benchmark survey. This underscores the importance of market share as a critical competitor indicator of success online. After all, if you’re spending a ton on media and content optimization and not outgrowing competitors, what’s the point?

However, not all Amazon market share solutions are equally set up for success. Why? Because they haven't kept pace with complexity.

Since the first generation of Amazon market share tools launched a decade ago, Amazon has greatly evolved in complexity, requiring more modern, next-gen approaches to estimations. It’s no longer enough to make projections purely based on the frequent collection of “demand signals” such as best seller rank and pricing. This is table stakes.

Rather, algorithms must be expertly trained to react and adapt to several complex scenarios unique to Amazon’s wild and wacky marketplace. Otherwise, brands can’t separate the signal from the noise and trust their estimates enough to share with their CEOs and dictate bonuses.

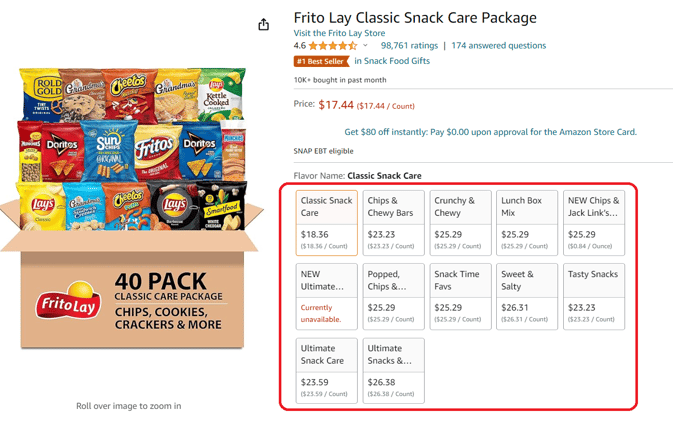

What kind of complexity are we talking about? Here are some examples:

-

Variant fluctuations – Almost every parent ASIN has a multitude of “children” variants (like pack sizes, flavors, etc.) that share best seller rank with their parents. Since variants can often break on Amazon, separate, and re-attach to other parent ASINs, this can create a lot of noise and inaccuracy in estimates.

-

Virtual bundles – More brands are launching “virtual bundles” as a strategy to increase average order size and profitability. Since Amazon does not break out virtual bundle sales in ARA, brands must solely rely on estimation to get this data. However, without an expertly trained algorithm, it can be challenging to attribute bundle sales back to the originator ASIN brands and sales can be double counted creating a false share estimate. In fact, for one Toy brand, virtual bundles contributed to a 20% share overestimate.

-

Long tail proliferation – Amazon lists approximately 700 new products per category every month*, the majority of which have low sales and thus, weak demand signals. These “long tail SKUs” can create a lot of noise in estimation models if not properly tuned and calibrated.

-1.png?width=707&height=461&name=image%20(6)-1.png)

Source: Profitero data

* Average no. of new products per month between Aug-Oct, 2023, 29 categories studied including ambient grocery, beauty, DIY, health & personal care and toys & games

In addition to these complexities (which Profitero’s algorithm captures), there's the complexity of quality checking data inputs. For example, actual sales data from Amazon Retail Analytics (an important input for most models) is volatile with strange anomalies and jumps that are later restated. Anomalies can be magnified during tentpole events like Prime Day. This is why it’s so important to have a large amount of actual sales data on hand to detect ARA anomalies before they impact reported estimations.

Not to be overlooked is the importance of categorization and branding, too. If your categorization is off and you're missing key products, it doesn't matter how good your estimations are. That’s why it can be risky to work with a provider who puts the onus of categorization on you versus managing it themselves with the expertise, data science and full focus it deserves. Many brands simply can’t keep up with regular categorization updates, which leads to unreliable estimates.

The point is: Amazon share estimation is hard, and like most things in life, there is no one magic bullet to ensure accuracy.

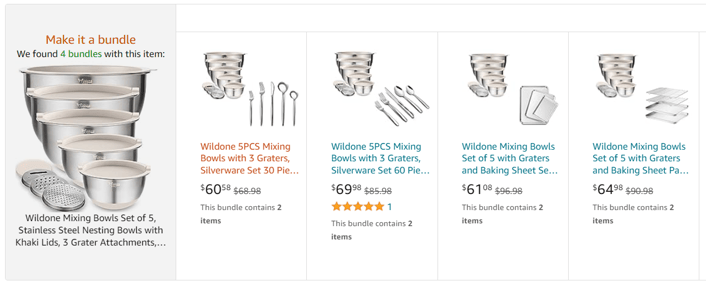

You have to get many things right every single day and continuously adapt your algorithm to account for Amazon’s latest complexity. This framework below showcases a few of the key building blocks that must be in place to achieve what we consider a gold standard of accuracy – 90% or better. (I recommend you ask every provider how their methodology aligns with this.)

.png?width=770&height=513&name=12.23%20Building%20blocks%20blog%20chart%20(4).png)

Practice makes for improvement: 90% accuracy doesn’t happen overnight

Beyond the technical elements of an estimation solution, it's important to choose the right partner with the experience to know when current methodologies are no longer good enough and must improve. After all, in the words of Les Brown, practice makes for improvement.

It’s a lot like flying. To fly a commercial 747 jet, a pilot must log 1,500 hours of training flight time. This allows them to be prepared for every scenario that could risk flight safety. In contrast, to fly a small Piper Cub, you only need to log 20 hours. There’s a big difference between professional and amateur.

Similarly, when evaluating Amazon share providers, it’s important to not just look at track record and experience, but also how long they’ve been training their algorithm for and what data they’re using to train it. Do you really want to trust the pilot with 20 hours of experience to fly your plane?

At Profitero, we’ve been continuously improving our algorithm to evolve with Amazon's complexity. Since we first launched Amazon Sales & Share in 2016, we’ve made more than 100 enhancements to our algorithm to maintain a 90% (validated) accuracy rate. We now sit on $100B of tracked sales across 150 categories and 10 countries, giving our algorithms a training set few others can match.

We’ve done sales & share longer than most, which allows us to do it better than most, especially when it comes to managing the critical nuances of correct branding and categorization. While you can never predict Amazon’s next new complexity, we’ve logged enough flight time and have enough historical data to know when the weather patterns have shifted and it’s time to adjust.

Of course, accurate sales & share data is only useful if it’s actionable. Beyond accuracy, we’ve made Amazon market share more actionable by linking it to causal analytics (digital shelf) and optimization tools designed to grow the market share you need to measure. Watch our video below to see how:

In conclusion, Amazon market share is critical to every brand’s success. Choose the right experienced pilot to help you fly the plane and you can navigate through any new complexity that comes up. Click here to learn more about Profitero’s industry leading Sales & Share solution.