With the first 24 hours of Prime Day in the books, we had an opportunity to sort through our biggest observations so far.

Here’s what we found:

What was the same as last year?

1) Amazon promoted its own products — very aggressively

No surprise that Amazon is pushing its own devices and private label products hard. The retailer wants all consumers, Prime members or not, as part of its Alexa ecosystem so it can continue to sell them add-on products and services and increase their lifetime customer value.

- Some of the hottest deals from around the globe, both in the run-up to and during Day 1 of Prime Day, were on Echo Dot, Echo Flex, Ring Video Doorbells and Fire TV Sticks.

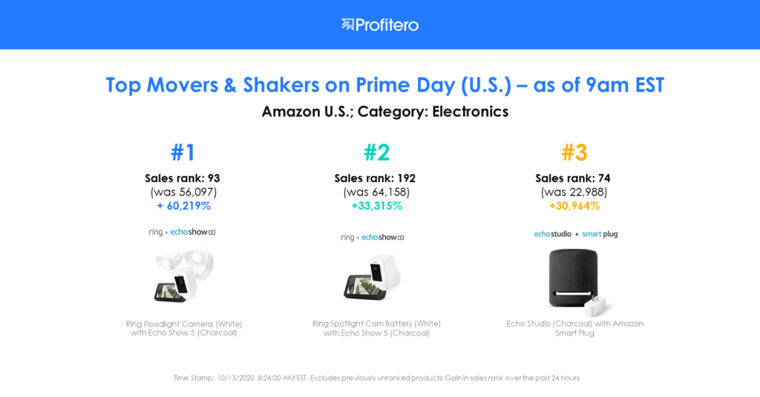

- By 9am EST, Amazon products dominated the Electronics category Movers & Shakers list in the U.S., capturing eight of the top 10 spots. The three top spots all belonged to Amazon.

2) Competing retailers tried to steal the show

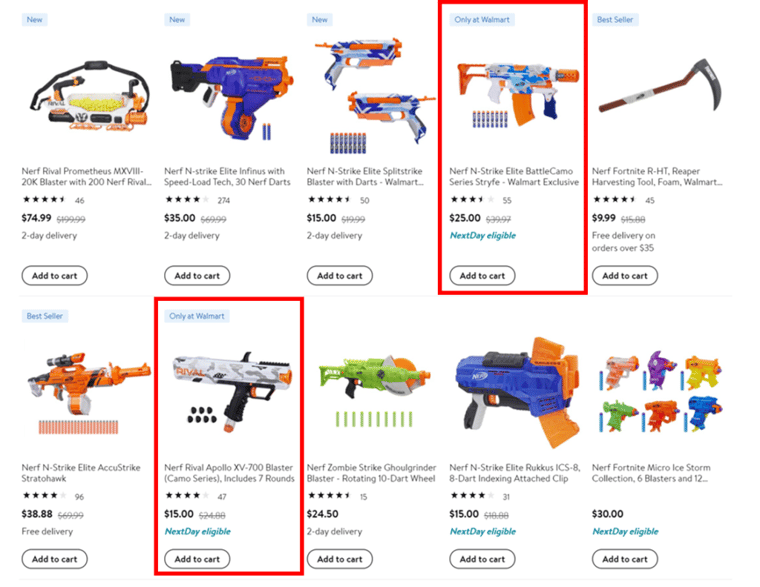

- In the U.S., Walmart’s answer to Prime Day was offering deals on products that were exclusive only to them. For example, we counted 43 “exclusive to Walmart” toys, including six exclusive NERF gun products, being offered on day 1 as part of the retailer’s Big Save event.

- Like last year, Target in the U.S. promoted its own Deal Days during Prime Day. The retailer also offered free same day delivery via Shipt for orders of more than $50, a good deal for anyone who wants groceries.

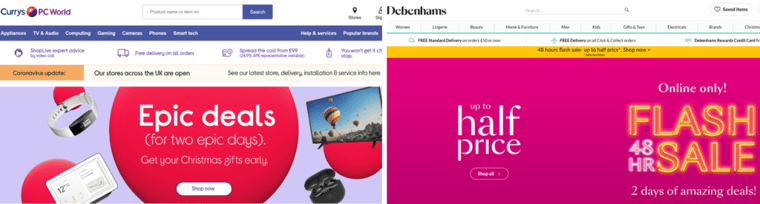

- In the U.K., Argos, Currys PC World and John Lewis were among the retailers holding their own flash sales during Prime Day.

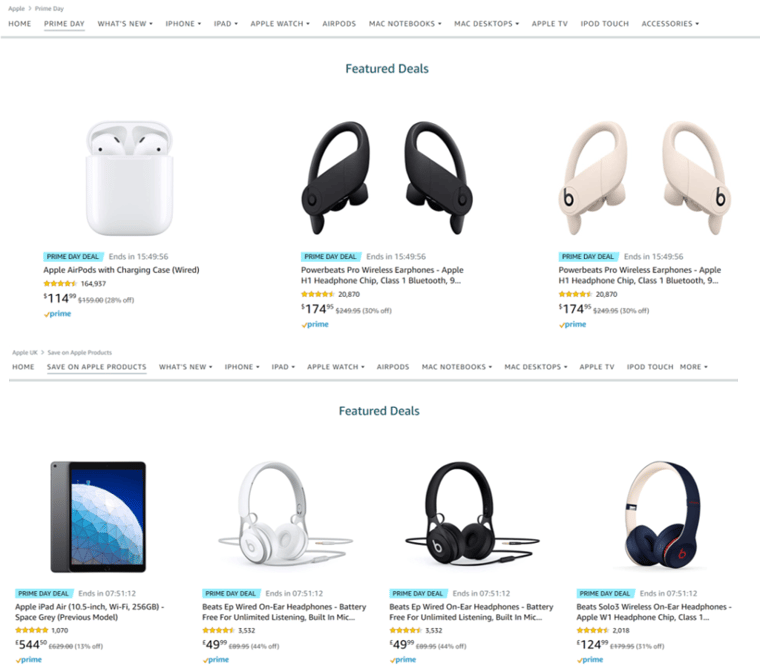

- Coincidence or not that Apple launched its latest iPhone 12 model on the same day that Prime Day kicked off? Still, this didn’t deter Apple from double-dipping by also promoting its wares with Prime Day deals on Amazon in both the U.S. and the U.K.

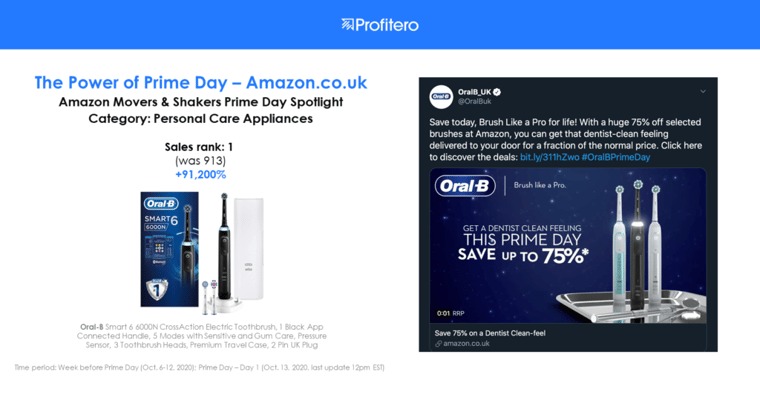

3) Some brands invested in promotions “off Amazon” to double the effect of their deals

- Oral-B is a good example of a brand that aggressively promoted both on and off Amazon on Prime Day. The personal care brand had ads on Amazon’s home page, Amazon banners on other sites and a Twitter promotion. This flurry of activity helped propel the brand up Amazon’s Best Seller rank from #913 to #1 in Personal Care Appliances on Amazon.co.uk.

- Some fashion brands — including Levi’s, Rayban, Fossil and Calvin Klein — were promoted on influencer (e.g., BuzzFeed) and key media publication lists (e.g., Cosmopolitan Magazine). The recommendations seemed to pay off with Fossil’s touchscreen watch moving up 656% and Calvin Klein’s cotton bralette (below) moving up 716% in the Best Seller Rank on Amazon.

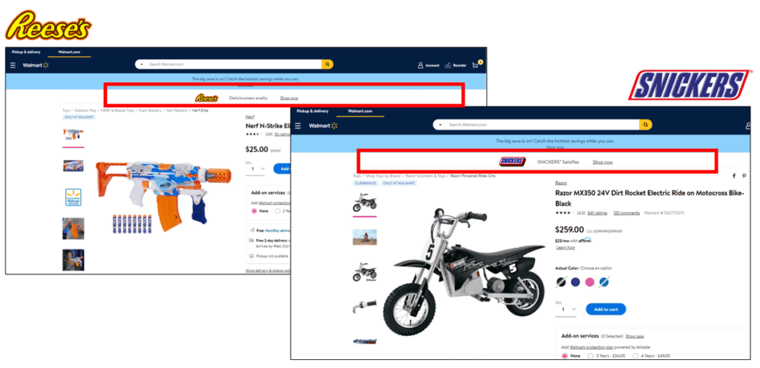

4) Brands used “cross pollination” tactics to get in the basket

- During the Walmart Big Save event, we saw candy brands capitalize on “deal traffic” to Toy pages, presumably to be top of mind with parents for Halloween.

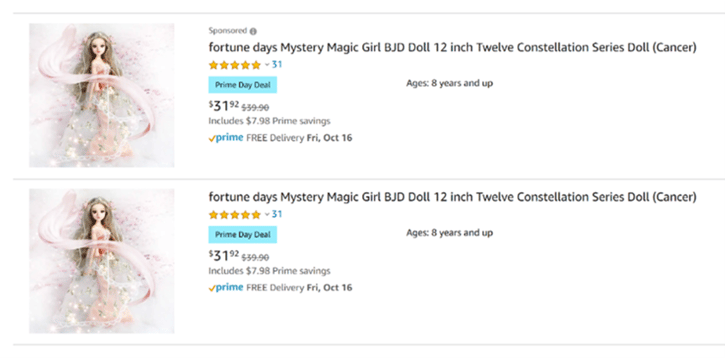

5) Brands doubled down on their “deals,” paying to have the same product show up as sponsored next to organic results in search.

- The Mystery Magic Girl doll by Fortune Days below is just one example. But we saw this happen several times across different categories.

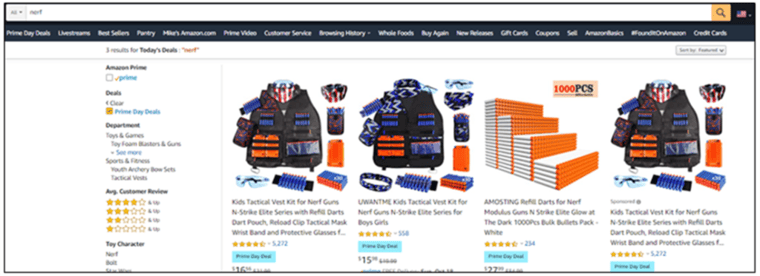

6) 3P sellers benefited from the halo effect of other brands

- Despite being announced in Amazon’s press release, NERF did not have any Prime Day deals running, at least not on Day 1. (It did offer a few limited time discounts, just not under the Prime Day banner.). So this 3P seller selling a NERF gun bullet vest was able to capitalize on consumers searching for Prime Day deals offered by NERF, and is now out of stock.

What was different than last year?

1) Celebrity endorsements were largely absent this year. In fact, we counted zero.

Also missing: Any big splashy launch of celebrity products like we saw last year with the new Lady Gaga/Haus Laboratories beauty line. We can only assume it was too tough to pull off with so much uncertainty surrounding this year’s Prime Day i.e., if and when it would actually happen.

2) Pandemic trends influenced deals and top sellers in some categories

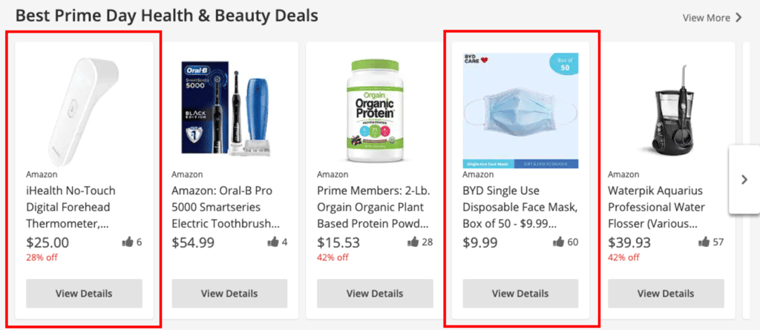

- In a nod to “you never would have seen it in past Prime Days,” a no-touch digital forehead thermometer and disposable face masks led the “best” Prime Day deals in Health & Beauty being featured on Amazon’s home page this year.

- The pandemic pampering trend was notable, with self-care and maintenance products from brands like Gillette, Remington and others quickly moving up the Best Seller Ranks in both the U.S. and U.K., and earning top “Movers and Shakers” spots for Day 1.

- Some Pet deals seem to target new pet parents, those adopting pets during the pandemic. For example, Embark’s Breed Identification Kit (a pet DNA test) jumped up 16,760% to the #10 ranked spot on Amazon in the U.S. And a Furbo WiFi dog camera rose 2,707% up the Best Seller Rank in the U.K.

- Other items benefitting from pandemic trends that moved up the Best Seller Rank in their categories: Fitbit Versa (home fitness boom) up 4,550% to the #2 spot in Sports; and Usboo outdoor string lights (for the backyard oasis) up 1,752%, moving from #463 rank to #25 on Prime Day.

3) Small businesses played a larger role this year

Amazon invested millions on promotional activities to help small businesses around the world increase their sales and reach new customers. In the weeks leading up to Prime Day, customers who bought goods from small businesses (spending $10 in the U.S. or £10 in the U.K.) earned a credit (the same $10 in the U.S., £10 in the U.K.) that they could then use on Amazon on Prime Day.

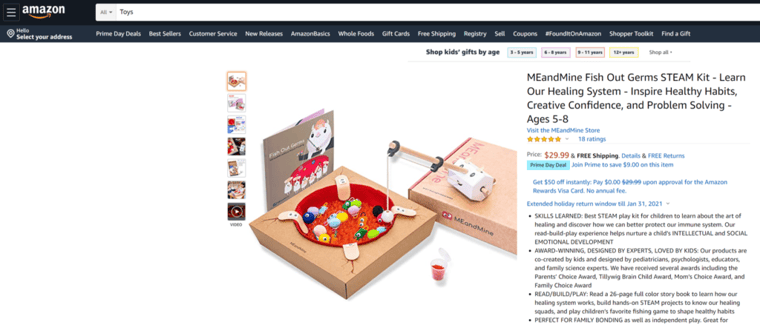

- Throughout the day, a few products in the Amazon Launchpad program hit page 1 for top category keywords, like this MEandMine Fish Out Germs game below did for “toys.”

- Two different U.S. small businesses selling beeswax wraps, Bee’s Wrap and Cultical, took advantage of the small business Prime Day promotions. Both gained several spots in Best Seller Rank during Day 1, up 84% and 47% respectively.

- In the U.K., featured small business Sandy Leaf Farm reported that its “sales on Day 1 eclipsed a normal trading day.” We saw Sandy Leaf Farm’s Ultimate Gin Maker’s Kit (yes you can make 10 bottles of your own gin) increase its Best Seller Rank by 506%, moving from spot #376 last week up to #62 on Prime Day.

Some key differences observed across different markets

1) Brands had different strategies for different markets

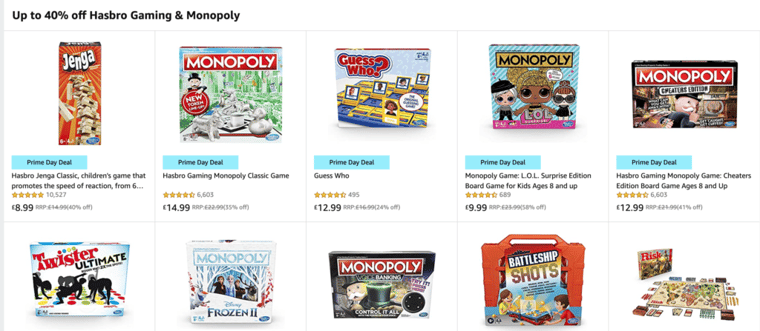

- In the U.S., for example, Hasbro only promoted a handful of board games during Prime Day (mostly Star Wars based). But in the U.K., it made a big push for board games, offering deals on 21 games ranging from Jenga to Monopoly to Guess Who?

2) Nintendo Switch got a big splash in the U.K.; not so much in the U.S.

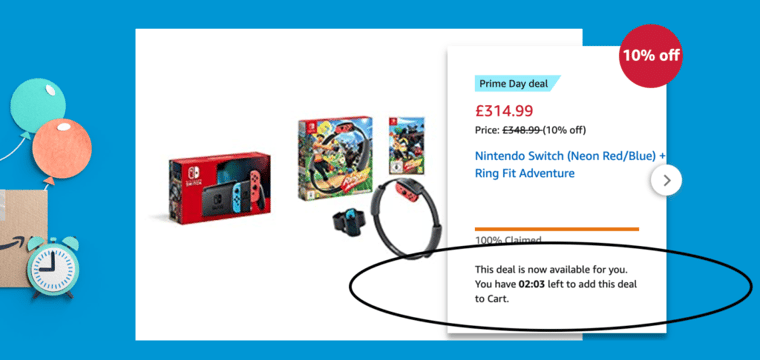

- Nintendo Switch was one of the hottest Prime Day items in the U.K. despite being offered at just a 10% discount. But if you aren’t an early riser, you missed out. The Nintendo Switch deal was 100% claimed by 8:39am local (U.K.) time. Meanwhile in the U.S., the item was not promoted on Prime Day at all due to ongoing stock issues.

3) Electronics were especially hot in Germany and Japan. The vast majority of Prime Day deals in Germany were focused on the Electronics category. And in Japan, Prime Day deals for some Electronics products were going quickly, e.g., an ASUS Chromebook sold out in just two minutes.

Winners from Day 1 — Category Deep Dives

BABY

BEAUTY & PERSONAL CARE

CLOTHING, SHOES & JEWELRY

ELECTRONICS

GROCERY & GOURMET FOOD

HOME & KITCHEN

HOME IMPROVEMENT

PET

TOYS & GAMES

Contact Profitero to learn how you can get the eCommerce data and performance analytics you need to monitor and adjust your seasonal event strategies in real time.