We’ve seen this before — a massive widespread illness sending the world into a frenzy and quickly impacting demand for medical equipment and supplies. Before it was the Bird Flu, now it’s the “coronavirus.”

The coronavirus is a deadly type of common virus that has affected more than 7,700 people throughout the world, and counting. The majority of those infected are located in China; however, the virus, and the mass hysteria it has caused, has spread into countries across the globe, such as France, Australia and the U.S.

At Profitero, we decided to take a look at the impact the coronavirus is having on eCommerce.

The coronavirus eCommerce impact so far

In the Chinese domestic market:

Within days of the virus being reported, major online channels began to see a jump in demand for medical supplies in numerous countries. Consequently, multiple Chinese brands that sell on digital retail platforms like Alibaba’s Taobao, Tmall, JD.com and Pinduoduo have been struggling to meet the growing demand, leading to depleted inventory and lost sales. Taobao alone sold 80 million facemasks in a 24-hour period between January 20-21. Other popular medical products such as hand sanitizers, medical goggles and scrubs are currently out of stock on Pinduoduo.

In the U.S. market:

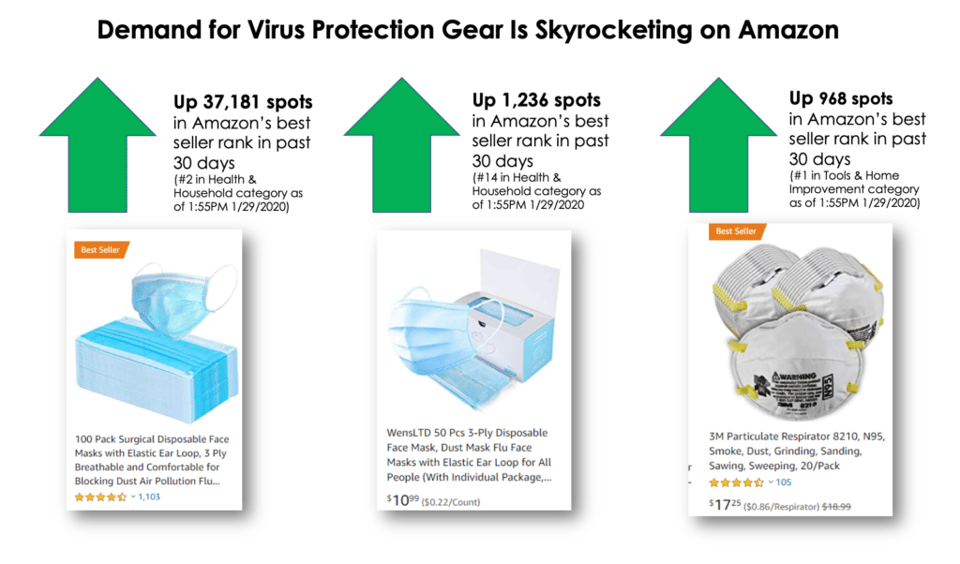

Although the numbers of those affected in the U.S. does not compare to China, panic is starting to spread and demand for medical supplies is increasing, as witnessed most immediately on Amazon. Below Profitero has called out some of Amazon’s biggest gainers in sales rank (a proxy for measuring best selling products) over the past 30 days since the coronavirus began to pick up media coverage.

As the sales rank of products increase, usually the price does as well. Some platforms are getting ahead of this issue by limiting how much vendors can raise their prices for certain medical supplies, but others aren’t. According to Profitero’s research, a 100-pack of medical face masks on Amazon almost tripled in price against its 90-day average price of $9.58, selling now at $29.00.

Opportunities for brands to capitalize

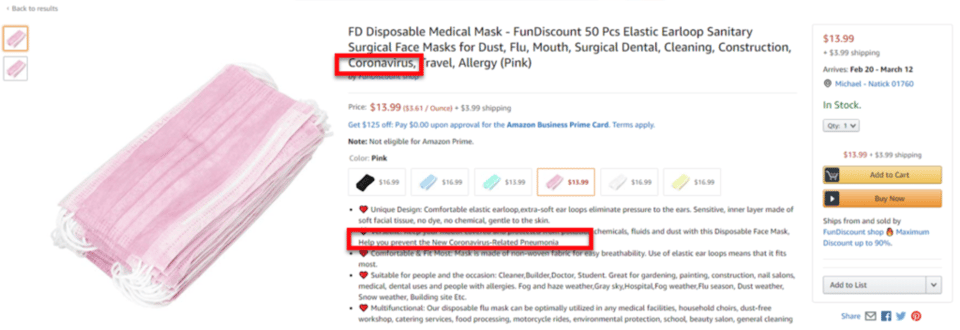

While not too widespread yet, we are starting to see products incorporate “coronavirus” in their product description copy.

This is not just a tactic being used by 3P sellers looking to capitalize on cheaply made medical masks. As Garrett Bluhm noted in his post on LinkedIn, Clorox has started to incorporate “coronavirus” in their product description bullets. While that does not seem to have had an effect on Clorox’s organic ranking for the term “coronavirus” so far on Amazon, it could pay dividends in the long run.

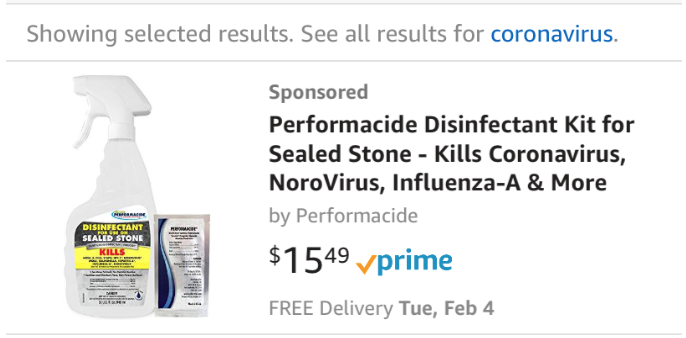

Several enterprising brands have started sponsoring “coronavirus” as a keyword; but on the whole, few of these products are relevant to what consumers would actually be searching for to protect against the virus, such as wipes and masks. Due to this, it will be interesting to see which major brand in the disinfectant space makes the first move here.

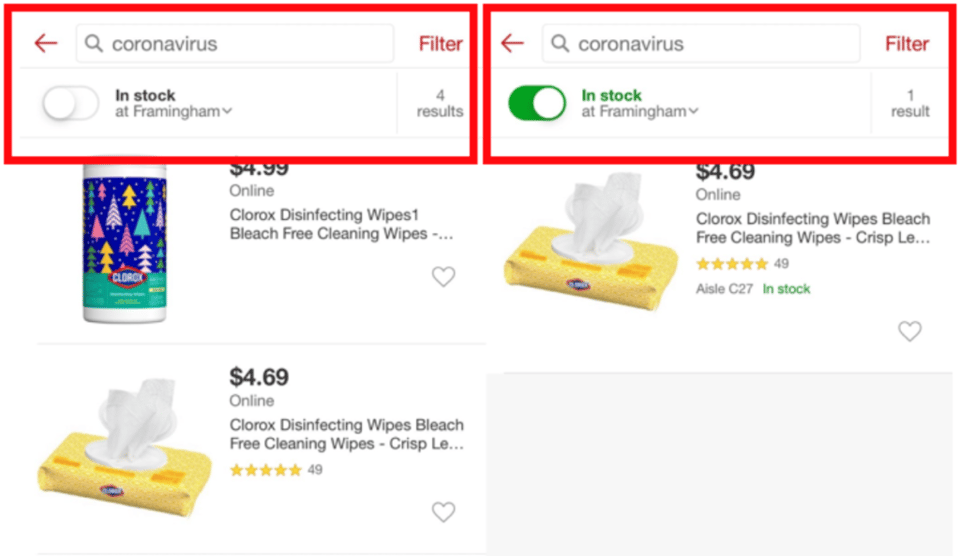

Finally, it’s important for brands to think beyond Amazon for the opportunity to be relevant as consumers seek protection against viruses. In fact, click and collect retailers like Walmart and Target may be the best way for consumers to purchase supplies given the need for instant protection. For brands, that means you not only have to maximize visibility for the relevant keywords, you also have to be in stock. Right now, Clorox is dominating visibility for “coronavirus” on Target, but when we look to see if it’s in stock for pick up at the store, the choices of assortment drops significantly.

Clearly, worldwide news and trends can influence the way consumers shop and brands sell online. Similar to the “hype” generated around the swine flu and the Zika virus, something as unforeseen as a global illness can spark changes that brands need to react to quickly in order to make a difference, and meet consumer demand.