In our 2018 Global eCommerce survey, Profitero and Kantar discovered why eCommerce analytics will be a key driver of growth for many manufacturers in 2019.

Just over half of all global respondents highlighted measuring and reporting on how eCommerce is performing within their organisation as one of the top challenges they are facing.

This, in turn, explains the significant growth and interest in eCommerce analytics, with 73% of manufacturers now allocating some portion of their eCommerce budget to Data and Analytics services.

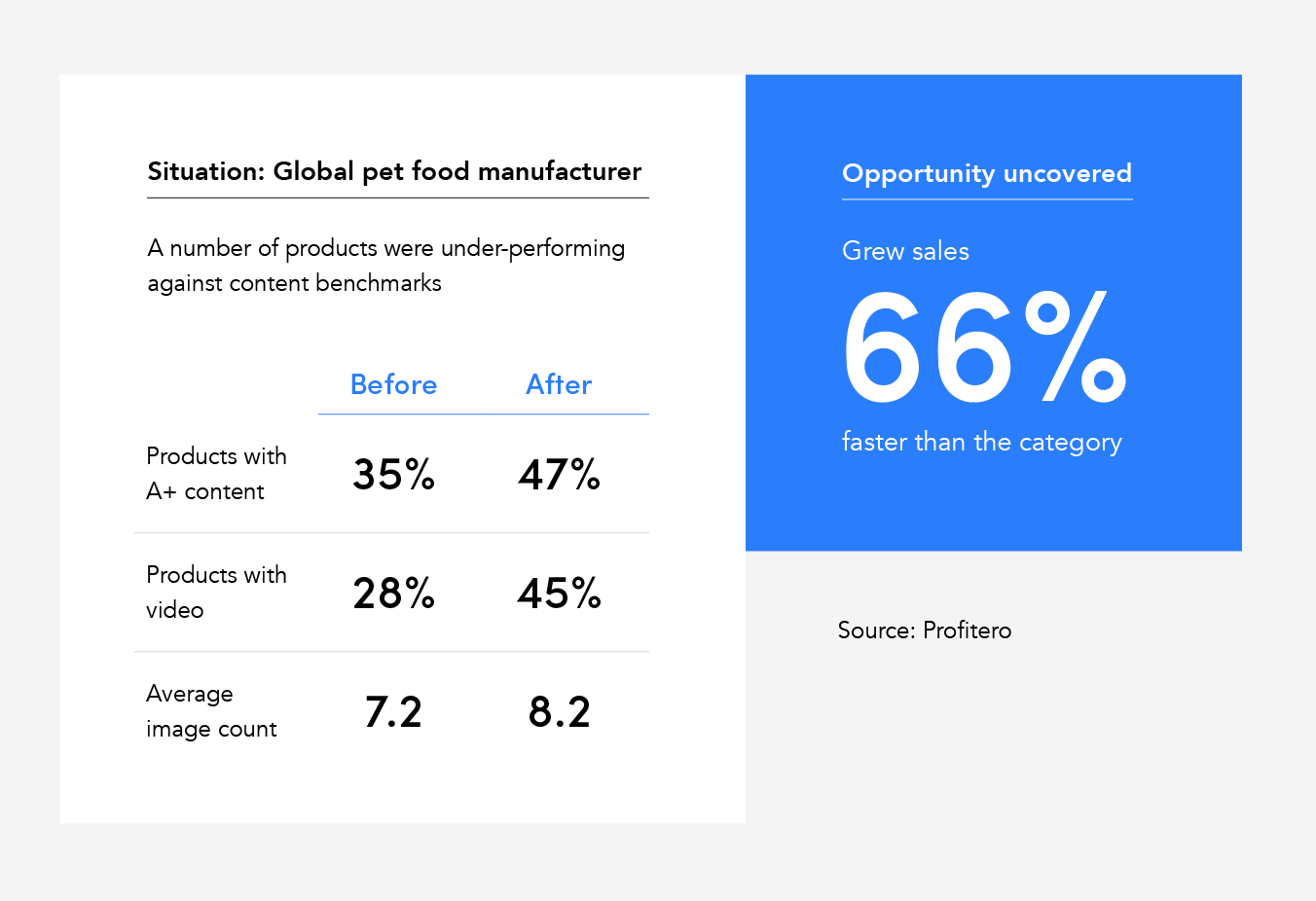

The power of eCommerce analytics can be seen in this example of a global CPG manufacturer who significantly grew sales in a category simply by identifying and then improving its product content.

The eCommerce Flywheel: Benchmark, Test, Learn

Progress is certainly being made for the majority of manufacturers in creating an environment where they can benchmark, test and learn from new eCommerce initiatives. They do this by starting with a clear eCommerce vision and then use this to determine three important decisions:

- What are realistic eCommerce growth targets based on my current capabilities and resources?

- What additional resources do I need to stretch these targets (both in terms of headcount and digital toolkit)?

- How can I drive usage and understanding of analytics throughout my organisation to create a company-wide focus on eCommerce growth?

However, many still see the acquisition of data and analytics as the panacea for all eCommerce challenges. In reality, with often vast amounts of data to interpret and make sense of, eCommerce teams may end up with greater confusion or – even worse – risk wasting their significant investment altogether.

We flag three key pitfalls to overcome to avoid wasting significant investment:

1. A lack of focus on eCommerce being driven throughout an organisation.

eCommerce leaders must play a key part in this, through highlighting how eCommerce analytics can quickly highlight new areas for focus or development – by testing opportunities that are simply not available in the offline world.

2. Buying a digital toolkit and adding eCommerce headcount before a clear strategy is even defined.

Again, it is the role of the eCommerce leader to define what specific workstreams will be created (covering areas such as Product Content, Paid Search Media etc). Once this is done, the company can then make clear and informed decisions on what additional headcount is required, and what elements of a digital toolkit will help ensure these workstreams achieve their goals. With a plethora of options to choose from, only a clear strategy can help guide the purchase decision of the right eCommerce analytics tools.

3. Creating an eCommerce data analytics team in isolation, without involvement from all departments within the value chain: Marketing, Supply Chain, R&D.

This results in a lack of clear understanding of eCommerce and how it can impact offline sales. Embedding the data within the organisation through clear measurable KPIs is one tactic to help establish eCommerce and digital knowledge as a company-wide commercial competency.

In his presentation on Day 1 of the Kantar eCommerce and Digital Strategy conference (May 15-16, Amsterdam), Andrew Pearl will provide clear guidance on how forward-looking brands are structuring for eCommerce success by using the power of eCommerce analytics to drive out-performance in 2019.