In 1935, a market researcher named Arthur Nielsen invented what would become an industry changing concept: market share. For the first time, brands had a way to measure their sales relative to competitors and relative to their category’s overall growth. Finally, they could understand whether the new products and marketing campaigns they were launching were actually impacting growth.

In today’s eCommerce world, the concept of market share is even more valuable than when Art Nielsen first conceived it. For example, in the retail world, the space you can allocate for products is limited; but online, shelf space is unlimited. This removes the traditional distribution hurdles and barriers to entry small brands typically face in traditional brick and mortar. So, as a result, the competition any one brand can face is virtually limitless. And with the proliferation of digital and social media, brands don’t need to have budgets the size of a P&G or Unilever to get their message across; they can take share by being scrappy. In this fragmented retail and media landscape, measuring one’s market share relative to all competitors (both online and off) is the only way to stay one step ahead.

Are all ways of measuring online market share created equal? …No

You’re a brand manager and your CMO has asked you to provide a market share estimate of your sales in traditional retail and on Amazon. Naturally, you would expect the methodology used across online and offline to be the same. In other words, you would expect that your share would be calculated by taking your sales and dividing it by the sales of all products in the category. That only makes sense, right? If you were measuring your share of the market across retail, you wouldn’t only care about how you’re performing against the top 5 items on the shelf – you’d want to know your performance against everyone.

But, in fact, some eCommerce analytics methods only measure share against a small subset of the category–typically the big, familiar brands with leading share in brick-and-mortar retail. They lack the sophisticated models to measure Amazon sales across all the products in the category, so they often under-represent the category quite dramatically.

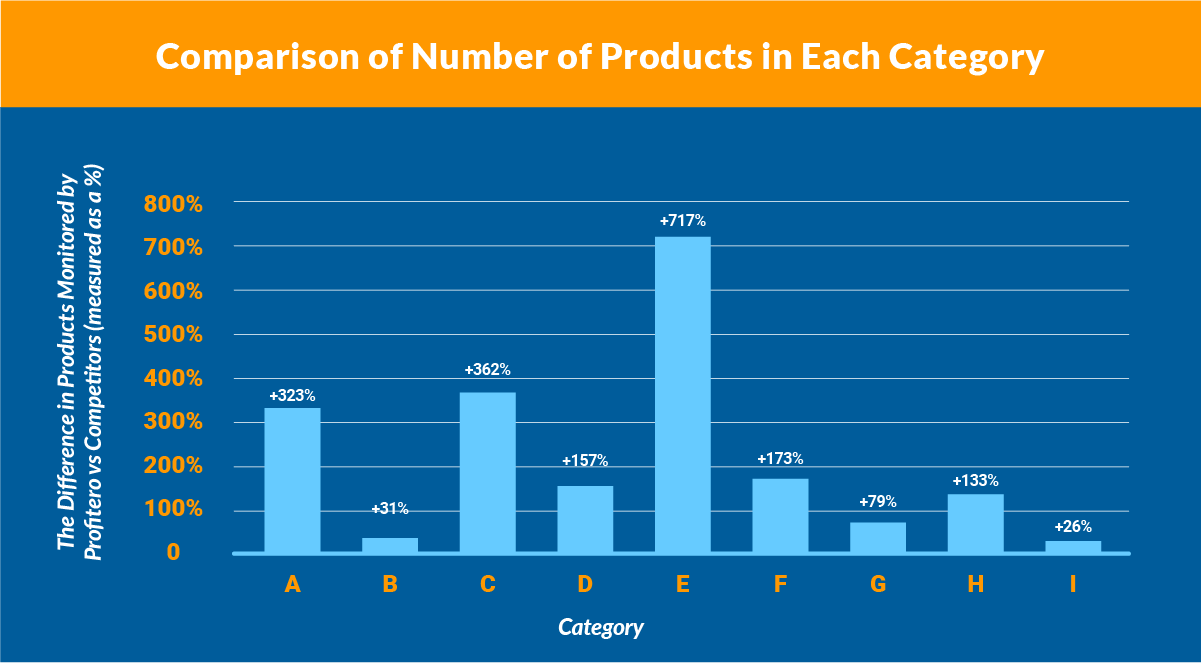

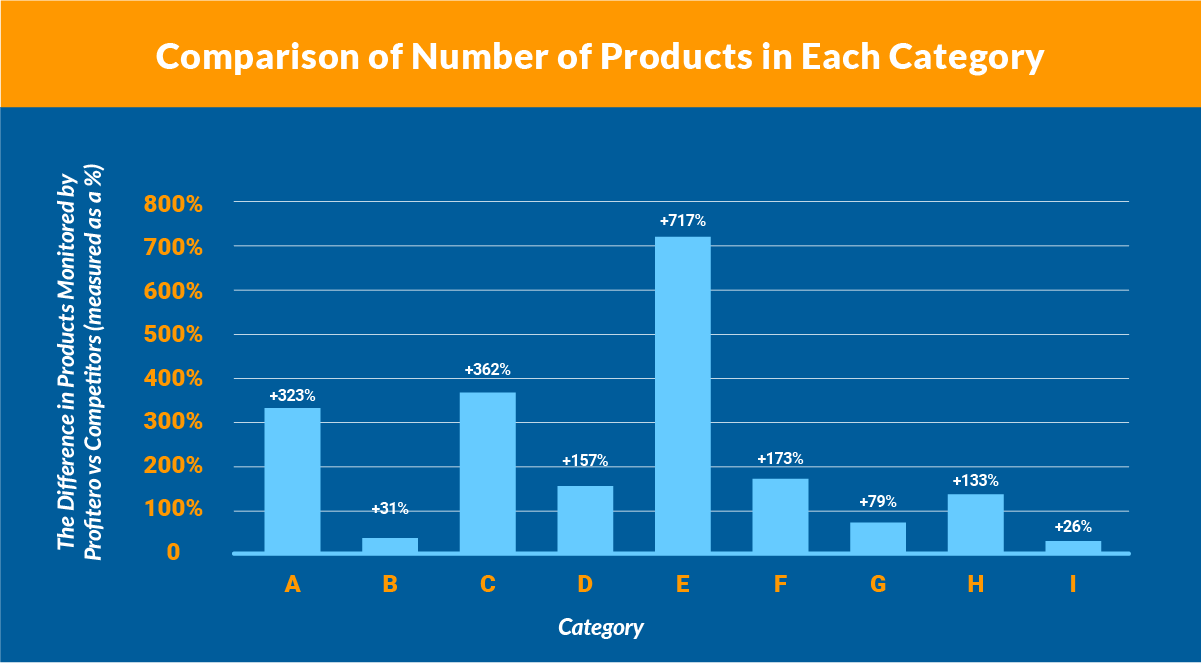

To give you an example, Profitero uses a proprietary, artificial intelligence based method for measuring category share that accounts for a broad representation of products in the category. Recently, a large manufacturer of snack and breakfast products asked us to provide the number of products we monitor for sales and share across their major categories online, which are also the major categories across all of grocery. Then they compared our figures against the number of products monitored by another eCommerce measurement provider in those same categories. On average, Profitero monitored sales and share for 2X as many products per category than the alternate provider – a gap that was too large for the manufacturer to accept.

Does having a full representation of the category really matter? Yes, and here’s why.

1. Without the full category represented, category size and share figures will likely be misstated. That means, when your CMO asks you for your Amazon share, you could find yourself in the embarrassing situation of giving her the wrong information, which goes to the CEO, which goes to investors … you get the point. But beyond embarrassment, misstated share can lead to bad decisions. If you think your share is higher than it is, you might be more complacent than you should be.

2. In a share model that under-represents the category, the products you are most likely to miss are those that are most crucial to watch on Amazon – basically, smaller and emerging brands. A good example: Hempz is the #3 brand in Hand & Body Lotions driven largely by 3rd Party sellers. With a methodology focusing only on the biggest brands or first-party brands, you might miss this key player as they creep up the category and win over shoppers. But if you catch them early, you can respond effectively to lessen their threat.

The Bottom Line

If you’re currently getting online share information – from any provider – be sure to keep this concept of category representation in mind. In their estimate of sales and share, are they representing the whole category, or just a few? And if you’re not certain, ask them to do a head to head comparison with other providers in the space. It could save you a lot of embarrassment – and poor planning – down the road.

To discover other important criteria for selecting the right eCommerce analytics solution, read The Definitive Buyers’ Guide to eCommerce Performance Measurement Solutions.