In the previous posts from our 5-part blog series ‘5 Ways to Optimize your eCommerce Performance with Amazon FastMovers’, we covered how these reports can help you analyze your competitors, identify emerging brands, and detect consumer and product trends.

In part 4 we look at how to use these reports to identify the number of 3P sellers in your category – and why it’s so critical to monitor this.

1P vs 3P on Amazon

When selling on Amazon, brands need to decide whether to sell via 1P or 3P on Amazon. The essential difference here is whether you establish a wholesale relationship with Amazon Retail (1P) or you sell as a third-party to consumers through Amazon marketplace (3P).

In order to sell through Amazon marketplace, brands can set up their own account or work with 3P partners. This can be a very attractive option for sellers to gain access to Amazon’s vast consumer base, and it’s no surprise why the number of 3P sellers has continued to grow.

How important are 3P sellers?

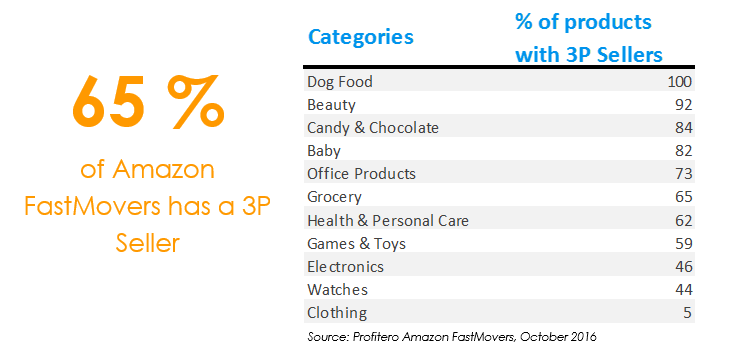

Profitero analysis shows that in September 2016 , 65% of Amazon’s best-selling products had a 3P seller and for top level categories like Beauty, Dog Food, and Candy & Chocolate, that number reached over 80%. This contrasts with Clothing, Watches, and Electronics where most of the best-selling products are still sold and distributed by Amazon.

The growing volume of sales captured by 3P sellers is becoming an issue that brands simply can’t ignore. Firstly, it represents clear demand at Amazon–demand that suppliers aren’t getting credit for.

And secondly, it can lead to loss of control over how brands are presented on the world’s most influential product research platform.

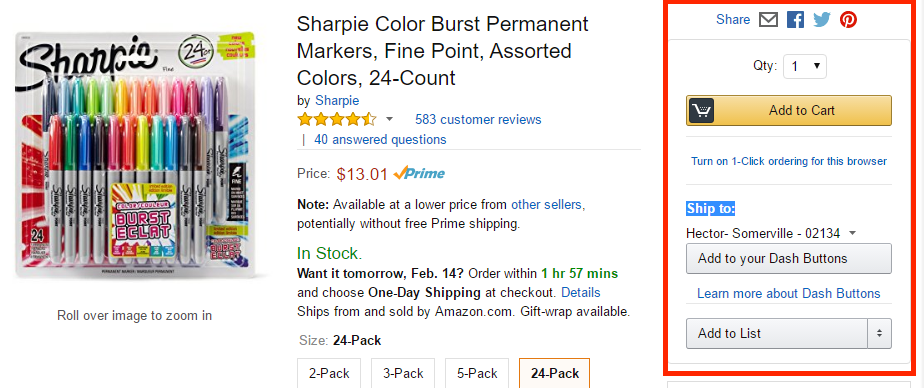

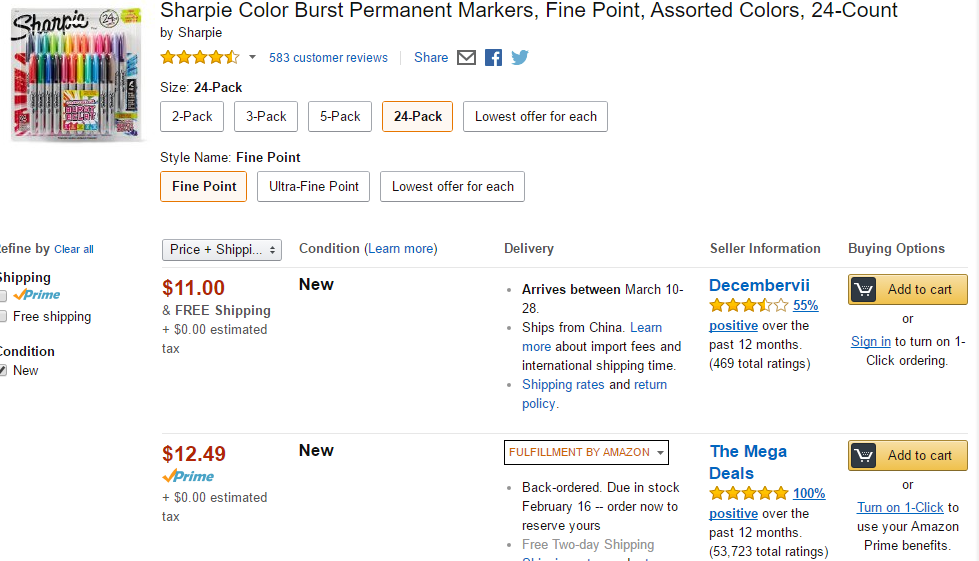

From a shopper’s point of view, they have the choice to buy directly from Amazon or buy from a third-party seller. However, the higher the number of 3P sellers, the more options the customer has – and the harder it will be to win the Buy Box.

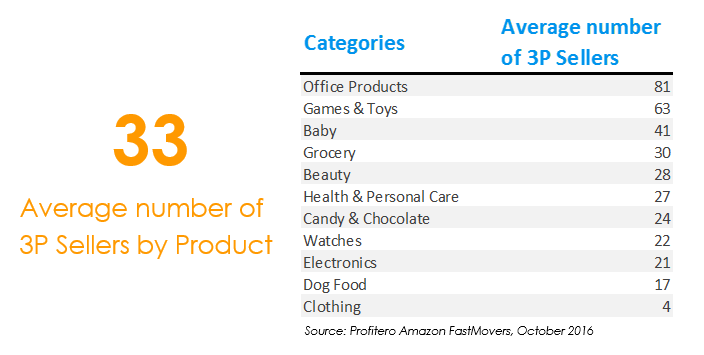

Further analysis of our FastMovers reports across categories reveals that on average, there are 33 3P sellers for each product. In highly competitive categories like Office Products, this number can be as high as 81 for each product – and for Games & Toys, 63.

Whether a brand decides to place their product on Amazon’s marketplace (3P) or sell them direct through Amazon (1P), it’s becoming increasingly critical to get insights into how your products are selling on Amazon.

Profitero’s Amazon FastMovers reports help you take a crucial first step in understanding the 3P dynamic in your category.

Subscribe to our free Amazon FastMovers reports or send us a request to find out more about our Amazon analytics, including how we help suppliers manage the 3P challenge.