We recently presented at the Nielsen Consumer 360 conference in Tokyo, Nielsen’s annual event that seeks to connect consumer trends across industries.

This is the first year that Consumer 360 comes to Japan, which takes place amid a world of unprecedented globalization and connectedness.

Finding opportunity within the current economic climate is both complex and challenging, however a massive opportunity remains for forward-thinking organizations that focus on the consumer of today’s digitally connected world.

Nielsen Japan Consumer 360 delivers the latest thinking on how to unleash growth while operating in a globally connected environment.

Japan: a market with significant eCommerce potential

According to the A.T. Kearney 2015 Global Retail eCommerce Index, Japan ranks #4 (behind the US, China and the UK) for countries with the highest online market attractiveness globally, based on several variables that rate both a country’s current eCommerce market and its potential for growth.

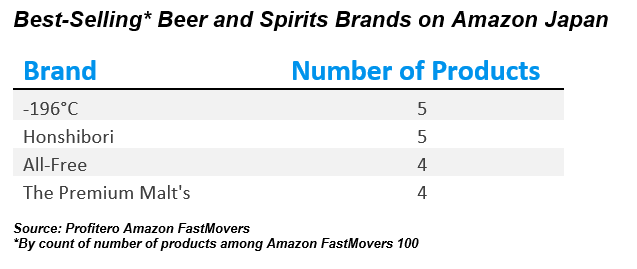

To coincide with Consumer 360 Japan, we took a look at key digital shelf metrics for Amazon Japan, which are taken from Profitero’s new Amazon FastMovers reports for Japan (reports that are free to download include Beer & Spirits, Dog Food, Hair Care, Make Up and Skin Care).

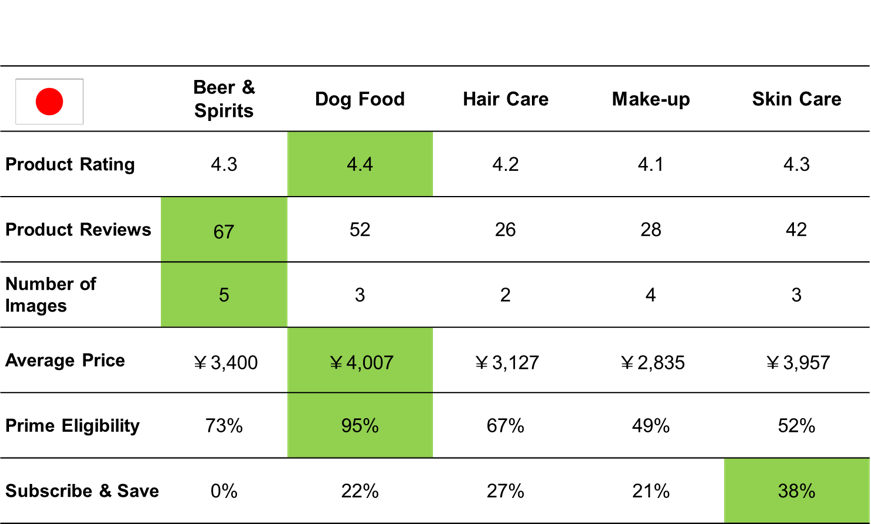

Below is a snapshot of how these five categories benchmark for key digital shelf metrics, such as product reviews and the number of product images, on Amazon Japan.

Digital Shelf Analytics: Amazon Japan

Source: Profitero’s Amazon FastMovers December 2016

Interesting differences are seen to exist across these five categories. The Beer & Spirits category had the highest number of reviews in December 2016 (with an average of 67 consumer reviews per product), contrasting with the Hair Care category which had only 26 reviews on average per product. Beer & Spirits also had the highest number of product images across these categories, with an average of 5 images per product.

When we analyzed Amazon programs, 95% of the top 100 best-selling dog food products on Amazon Japan are prime eligible (where Amazon Japan Prime subscribers can enjoy expedited shipping without incurring extra delivery costs as a Prime member).

However replenishment program Subscribe & Save is a different story, with only 22% of the top 100 best sellers in the Dog Food category eligible for Subscribe & Save. By contrast, no products in the Beer & Spirits category are Subscribe & Save eligible.

How does Amazon Japan compare to other markets?

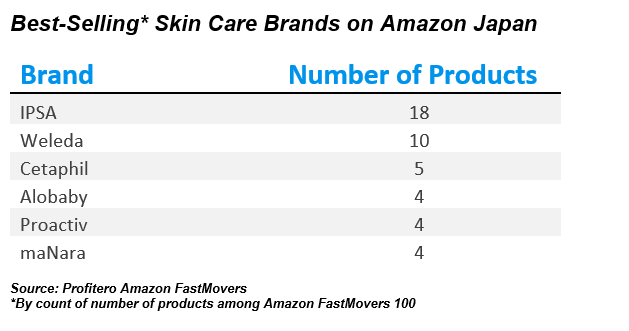

As more brands sell globally, it becomes critical to understand the dynamics that are specific to each country. To illustrate these differences, we compared digital shelf metrics for the Skin Care category across Amazon US, UK and Japan.

Digital Shelf Analytics for the Skin Care category on Amazon US, UK and Japan

Source: Profitero’s Amazon Fast Movers December 2016

If we look at product reviews – a key influencer for beauty product sales on Amazon (read our Q&A with beauty brand InstaNatural for more detail on the importance of ‘social proof’) – the Skin Care category on Amazon Japan had only 42 reviews for each product on average in December 2016. This contrasts with Amazon US, which had an average of 2,310 reviews for each product, and Amazon UK with 457 reviews per product.

There’s also significant opportunity to optimize product content in this category on Amazon Japan – another key area to drive sales, as it helps consumers learn more about the product and convert browsers into buyers.

The Skin Care category had an average of 3 images per product on Amazon Japan, half the average number of images in the same category on Amazon US, which benefits from 6 images per product on average.

To download your complimentary Amazon FastMovers reports for Amazon Japan in Beer & Spirits, Skin Care, Dog Food, Make Up and Hair Care, and to register your interest in future reports, click here.